They are hiring: September was better than expected in the job market

According to government data released Friday, hiring in the United States picked up significantly more than expected in September while the jobless rate crept lower, offering relief to policymakers ahead of November's election.

The world's biggest economy added 254,000 jobs last month, the Department of Labor said. This was markedly higher than August's 159,000 number, which was revised upwards.

A consensus estimate by Dow Jones had expected growth of 150,000.

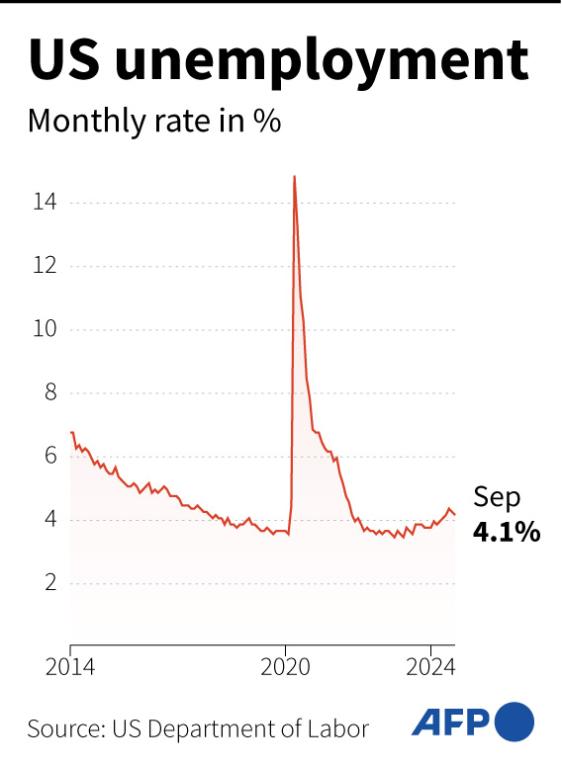

The unemployment rate dipped from 4.2 percent to 4.1 percent, the report added.

President Joe Biden lauded the job creation, adding in a statement that unemployment remains low and wages are growing faster than prices.

But he stressed: "We have more to do to lower costs and expand opportunity."

The health of the job market has come into focus over recent months as high interest rates bite -- but the pick-up in hiring should assuage some concerns that the Federal Reserve waited too long to slash rates last month, risking a downturn.

Economic issues are also among the most important for voters ahead of November's presidential election, as households grapple with higher costs of living after high inflation during the Covid-19 pandemic.

The Fed had rapidly hiked the benchmark lending rate in 2022 to ease demand and tamp down surging inflation. Price increases have eased in recent times, allowing the central bank to begin rate reductions.

As for wages, average hourly earnings in September were up 0.4 percent from a month ago to $35.36, slightly above expectations.

From a year ago, wages have risen by 4.0 percent, the report noted.

"The strong September jobs report confirms labor market conditions remain healthy, characterized by slower demand absorption rather than broad-based layoffs," said EY chief economist Gregory Daco.

Smaller rate cut coming?

The Fed's half percentage point rate cut in September was "unusually large" according to Dan North, senior economist for Allianz Trade North America.

"It's most likely that the Fed cut so much because it felt that it had fallen behind in its mission to balance employment and inflation," he told AFP.

CONTENIDO RELACIONADO

The stronger than expected figures on Friday might mean the Fed can take a more gradual path to cuts, given that the economy appears to be holding up.

Nationwide chief economist Kathy Bostjancic said Friday's report tempers the odds of another half percentage point cut in November, tipping the scales in favor of a quarter percentage point reduction for now.

The Labor Department noted "employment continued to trend up" in areas like food services, health care, government and construction.

Strike impact?

But a low response rate to the payrolls survey "waves a red flag," cautioned Samuel Tombs, chief US economist at Pantheon Macroeconomics.

"We think that small businesses are disproportionately late responders and are cutting back on hiring more than large businesses," he said, adding that September's numbers could be revised lower in coming months.

Economist Nancy Vanden Houten of Oxford Economics also warned that although a strike by Boeing workers did not affect September's employment data much, "job growth will likely be weaker in October if the Boeing strike persists into next week."

About 33,000 workers in the Pacific Northwest region walked off the job on September 13, effectively shutting down assembly plants for the 737 MAX and 777 after overwhelmingly voting down a contract offer.

But the resolution of a different strike, by dockworkers on the Gulf and East coasts, has "removed a major source of potential weakness in the October report," she added.

© Agence France-Presse By Beiyi SEOW

DEJE UN COMENTARIO:

¡Únete a la discusión! Deja un comentario.