These steps can help protect your money and your information

How a simple email or text message could open you up to fraud.

The pandemic has accelerated identity theft – and the impact on regular people is significant. In fact, Americans have lost more than $382 million to scams related to stimulus checks and unemployment benefits, fake treatments for COVID-19 and more, according to the Federal Trade Commission (FTC).

Even worse, Black and Latinx consumers are more likely to be victims of fraud than their white counterparts. That’s why it’s crucial to recognize activity designed to steal your hard-earned money.

JPMorgan Chase is available to help consumers learn to spot suspicious activity – from fake emails and texts to bogus claims about ways to stay healthy. We sat down with Chandra Williams, local community manager for Chase, to discuss tips and best practices for securing a better financial future.

Williams: Let’s start with emails and texts. Phishing is the fancy name for emails pretending to be from reputable companies – including banks. They’re really from criminals who are trying to get your personal information, such as passwords and credit card numbers.

The email could ask you to reply or click on a link that takes you to a website that looks like your bank’s site. Then they’ll ask you to give your username, password, account number, personal identification number (PIN), Social Security number or other personal information. Also, if you click on an attachment to that email, it could download software called malware that tracks or steals your information.

So, be very careful about clicking on a link in an email; instead go directly to the company’s website. And don’t click on attachments unless you’re sure it’s from someone you know and trust.

Scammers are increasingly starting to contact victims by text message or phone, most often from a number you don’t recognize, and telling you there’s a problem with your bank account, including that it’s closed, frozen or will be terminated unless you call a phone number or go to a website listed in the message and give your personal and/or account information.

Williams: Yes, here are a couple of surefire ones:

Scammers will often tell you there is a problem or a prize. They might say you are in trouble with the government, you owe money, someone in your family has an emergency, there is a problem with an account of yours, or that you won lottery money. Remember – if it sounds too good to be true, it probably is.

After setting up the problem or prize, scammers will pressure you to act immediately. They want you to hand over your sensitive information before you have time to think. They might threaten you, stress a sense of urgency, or say time is running out. However, no legitimate business or government agency will pressure you in this way or ask for your personal information, like your Social Security number, bank account or credit card numbers over the phone or email.

Williams: Here are few best practices:

Guard your online information. Download and update antivirus software for your computer, and don’t enter sensitive information into public computers or on unsecured networks. Also, be careful about giving out your financial username and passwords on the internet – this includes financial websites and apps that offer tools to help you manage your accounts, invest or prepare your taxes.

Make purchases only on secure websites. Look for the symbol of a lock in the address of an internet site. That will help protect your credit card number, expiration date and three-digit CVV.

RELATED CONTENT

Change your passwords often. Change your passwords frequently and use a combination of letters, numbers and special characters. Don’t use your pet’s name, your child’s name, or anything else that could be easily figured out.

Create a separate password for each financial institution. This provides an additional level of protection in case there is an issue at one institution.

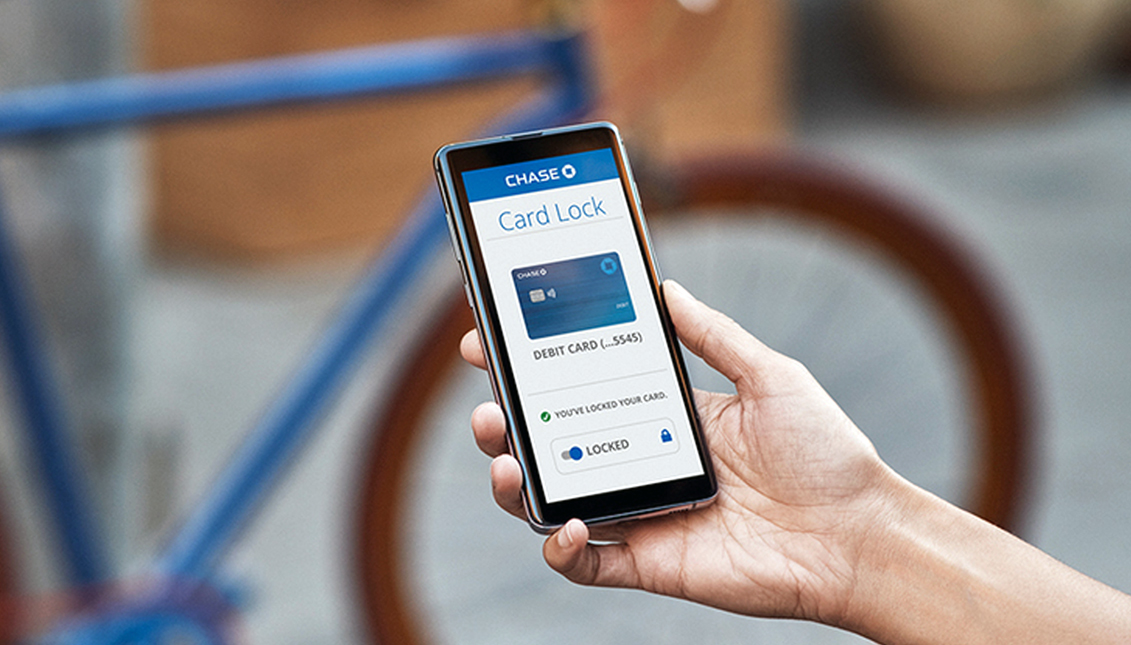

Monitor your accounts. Log into your accounts frequently – even daily – through online banking or on your mobile banking app to monitor transactions and your account balance. Look for transactions you don’t recognize. Also, check out your monthly statements and if there’s an issue, contact your bank right away.

Set up extra confirmation. The proper name is two-factor or multi-factor authentication. It just means you’ll need to take an extra step or two to access your information. For example, it could be requesting a text with a code be sent to the mobile phone number you gave the company before. At Chase, when you sign into your Chase account electronically for the first time or with a device we don’t recognize, we’ll ask you for your username, password and a temporary identification code. And we’ll send it to you by phone, email or text message.

Shred sensitive documents. Shred banking records, checks that you deposited through mobile banking and other documents that have your account information. Keep monthly checking and savings account statements in a secure location until you file your taxes and then shred these as well. Chase and other banks offer paperless statements, letting you see the information online without having to worry about paper.

Check your credit report. At least once a year, read through your credit reports carefully. You can request a free annual credit report from each of the three national credit reporting agencies, even if you don’t suspect any unauthorized activity on your account. Visit www.annualcreditreport.com.

Williams: We see it as a partnership; we help protect your accounts and information, and so do you. We monitor all of our accounts around the clock, including using security measures you can’t see.

Also, if we find or you flag a transaction that you didn’t authorize, we offer Zero Liability Protection, meaning you won’t be held responsible for it.

Stop by any of our local Chase branches to learn more about JPMorgan Chase’s commitment to customer security through our fraud prevention and protection tools. I look forward to working with you.

LEAVE A COMMENT: