Elizabeth Warren backs Philly Wealth Tax days before Mayor’s budget pitch

At the city level, the proposal is led by Councilmember Kendra Brooks, and is an effort to economically bolster one of the poorest cities in America.

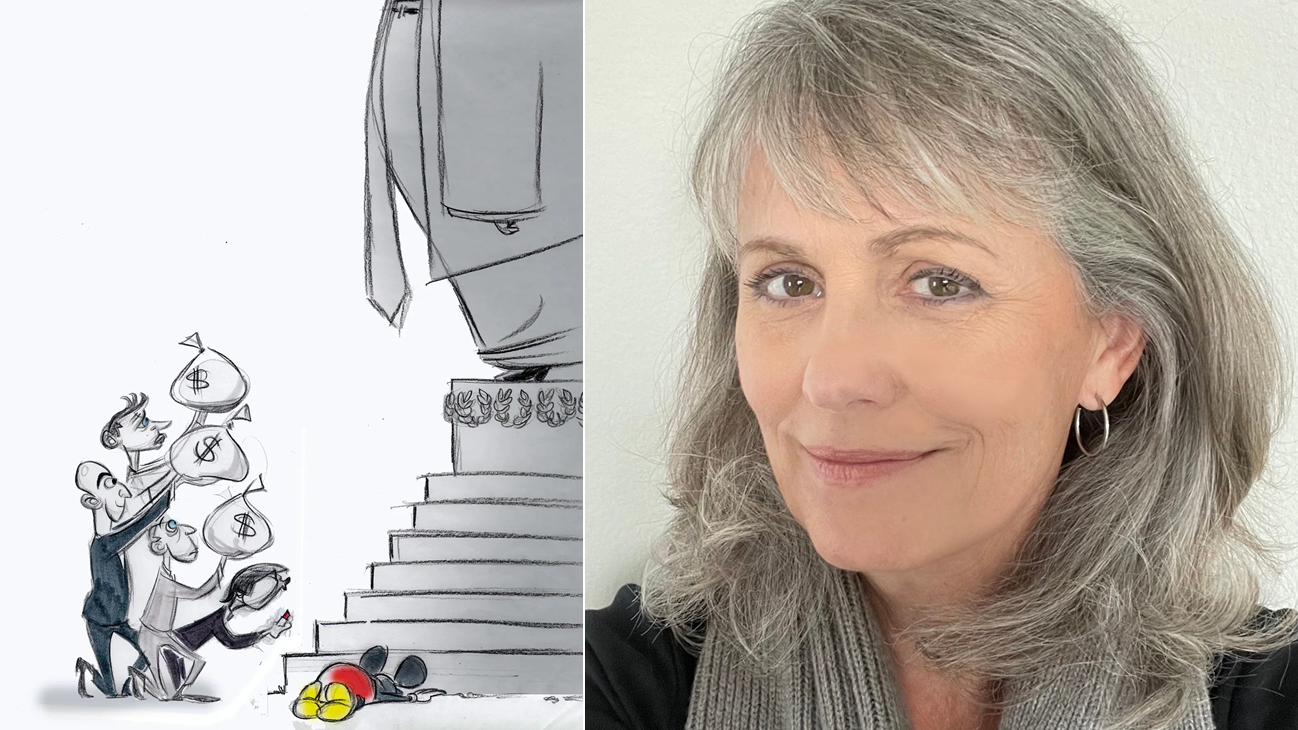

On Tuesday, March 29, City Councilmember Kendra Brooks, along with U.S. Senator Elizabeth Warren, presented the “Philly Wealth Tax,” a bill that would place a tax on all direct stock holdings, in an attempt to fix the country’s broken tax system.

This Tuesday, I'm announcing the Philly Wealth Tax alongside @SenWarren, @HelenGymAtLarge, @CouncilmemberJG, budget policy experts, community leaders, and the @TaxTheRichPHL coalition.

— Councilmember Kendra Brooks (@KendraPHL) March 25, 2022

RSVP to join us for the virtual campaign launch of #WealthTaxPHL!

⬇️https://t.co/9gfSk6Sbgi pic.twitter.com/RW9IpJO8gT

Even before the pandemic hit, Philadelphians, like residents in cities across the nation, are struggling to cover basic necessities such as housing, child care, food and utilities, and these costs take up a greater and greater portion of take-home pay for most individuals.

Almost one fourth of Philadelphia residents, and 34% of Philly’s children live below the federal poverty line, which is the highest rate among the country’s 10 largest cities.

On the flip side, the ultra-wealthy are thriving. Philadelphia billionaires alone have made hundreds of millions of dollars, such as Comcast CEO Brian Roberts, who grew his wealth by $200 million from 2020 to 2021.

During the virtual conference, Warren said that proposals such as this one are very popular with Americans because they understand that the system is rigged, and not in their favor.

“It allows the rich and the powerful to make themselves rich and more powerful at the expense of working families,” Warren said.

The public push for the tax comes just two days before Mayor Jim Kenney is scheduled to deliver his budget proposal to City Council for the fiscal year that begins on July 1.

The new proposal, which Brooks plans to officially unveil at this Thursday’s Council meeting, would tax Philadelphians at a rate of up to 0.4% of their direct holdings in stocks and bonds. Only about 15% of Americans have direct ownership of stocks.

"The long shadow of trickle down economics and austerity haunt my community to this day...

— Tax The Rich PHL (@TaxTheRichPHL) March 29, 2022

The Philly Wealth Tax is our collective answer to the status quo that has failed communities like mine for decades. " - @KendraPHL #WealthTaxPHL pic.twitter.com/DLwSP21FYc

Brooks’s office said that the tax could earn $150 million to $400 million per year. The city’s current budget is $5.4 billion.

Much of last year’s city budget negotiations were focused on spending, in terms of pandemic relief funds and violence prevention programs, but this year the primary focus is expected to be on taxes, due to a soon-to-be-released reevaluation of real estate values.

Brook’s proposal will most likely face an uphill battle, and is not expected to pass in the current Council, but progressives are hopeful that her campaign will shift the center of gravity in the debate over the city’s tax structure.

Sen. Elizabeth Warren joined Philly City Council Member Kendra Brooks today to announce the introduction of a wealth tax in Philadelphia, one of nation's poorest big cities. Lawmakers say the tax could bring $200 million to the city each year

— Akela Lacy (@akela_lacy) March 29, 2022

Many cities and towns in Pennsylvania, including Philly, had local taxes on financial holdings known as personal property taxes until the 1990s, when wealthy individuals and financial institutions rose in rebellion against them.

In 1997, the city abandoned its tax as banks threatened to leave the city. During the same year, there was a lawsuit against Montgomery County’s personal property tax by billionaire Walter Annenberg, the late owner of The Philadelphia Inquirer.

RELATED CONTENT

The following year, the PA Supreme Court ruled that part of the personal property tax was unconstitutional.

However, the court did uphold the right of local governments to tax individual wealth, and Brooks believes it time to bring the policy back to life, citing the recent studies showing that U.S. billionaires increased their wealth immensely during the pandemic.

“We can choose to make deep investments in working class neighborhoods that have been disproportionately impacted by the pandemic and by decades of disinvestment. We can choose to make everyone pay their share. And we can choose to fight for the city that our kids and grandkids deserve,” Brooks said.

Brooks and Warren were also joined by Councilmember Jamie Gauthier and union leaders representing the city’s non-uniformed workers.

Cathy Scott, President of AFSCME District Council 47, which represents thousands of city workers in the library system and parks and recreation, spoke about the severe lack of funding that these crucial city programs are dealing with.

“We have heard for years that libraries, recreation centers and mental health services couldn’t be funded properly because there just wasn’t enough money in the budget. Raising more money from a wealth tax, making people who made so much money during the pandemic actually share that with other people who live in the city is something that is very important to our union,” Scott said.

This wealth tax, which would be the first to be enacted in a major American city in decades, could serve as a blueprint for cities nationwide to address pandemic-related poverty and years of community disinvestment.

"A wealth tax is needed to bring parity to Black and Brown communities across Philadelphia, and vital to fund city services to make Philly as great as it can be."

— Councilmember Kendra Brooks (@KendraPHL) March 29, 2022

-Antione Little on behalf of @afscme33

The proposal is very popular among labor leaders and community advocates who have been pushing for deeper investments in city services for years. At the virtual conference, representatives from AFSCME DC 44 and AFSCME DC 33 expressed their support, as well as leaders from the Pennsylvania Working Families Party and the Action Center on Race and the Economy.

“We need to balance the scales and to do that we need to change the way that wealth is distributed. It’s long past time for the ultra wealthy to pay their fair share so we can fully fund city services and amenities and bring prosperity to working class communities,” said Councilmember Jamie Gauthier, a co-sponsor of the bill.

LEAVE A COMMENT: