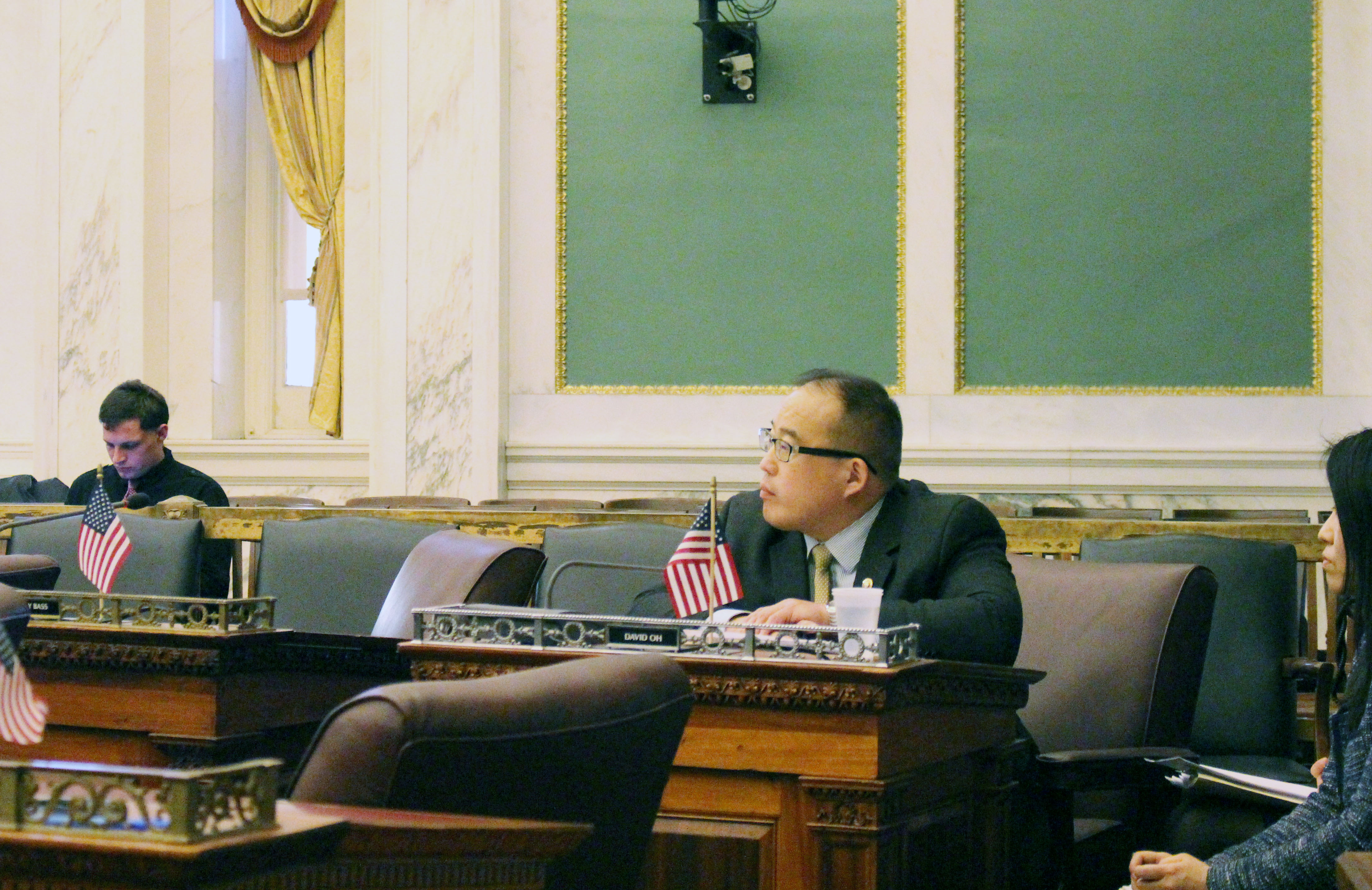

City Council hears testimony on bill to lower city wage tax

City Council heard four testimonies this morning on a bill introduced by councilman-at-large David Oh that would lower the city wage tax by one half by 2025.

City Council heard four testimonies this morning on a bill introduced by councilman-at-large David Oh that would lower the city wage tax by one half by 2025. Current wage taxes for city workers are 3.92 percent, which includes the state-based PICA tax. The bill (No. 140081) would also reduce the tax on net profits for businesses.

Both the pros and cons of the bill were represented. Each testimony acknowledged that the bill would have a major impact not only on those working the city, who would forfeit less from each paycheck to the city, but on the city’s economic growth as a whole.

The debate didn’t revolve around whether or not wage taxes need to come down. Council members unanimously agreed that city wage taxes were too high. Philadelphia bears the largest resident income tax in the nation, larger even than New York City’s. Lawrence Tabas, chairman of the Pennsylvania Intergovernmental Cooperation Authority (PICA), cited in his testimony the fact that 47.6 of city’s revenue comes annually from these taxes.

He also said that the debate was not about the necessity of reducing such a regressive wage tax, but the timing and schedule of implementing such changes.

“[The tax] hits the low-income residents of this city the hardest. It takes a larger percentage of their income because it is a flat tax. It is penalizing those who can’t necessarily escape to the suburbs and relocate. It’s also penalizing those who need the city’s critical services by making them pay a disproportionate share,” he said.

Rob Dubow, the city’s director of finance, spoke on the negative effects of the reducing the wage and net profit taxes, saying that it would bring a $115 million nonrecoverable deficit in the city’s budget over the next five years. In the city’s recent five-year financial plan, Dubow explained, more conservative decreases should be made on resident and nonresident wage taxes.

One key argument in favor of the bill is that it will encourage business growth in the city. While Philadelphia has staved off job loss since the recession, there has been little mention of missed opportunities for job growth. Suburban office parks like those in Conshohocken have become business meccas in recent years, and it’s not by coincidence that they chose to settle in the suburbs, Tabas said. Employees there get what Tabas calls an automatic wage increase just for choosing to work in Montgomery county instead of Philadelphia.

“If we’re going to be competitive,” he said. “We have to make it so that businesses can offer competitive wage packages and use that as an incentive.”

LEAVE A COMMENT:

Join the discussion! Leave a comment.