Tricolor patents Automás, new AI to expand financial inclusion for Hispanic communities when buying a car

Tricolor has a new tool learning to deliver a better. outcomes for its customer base.

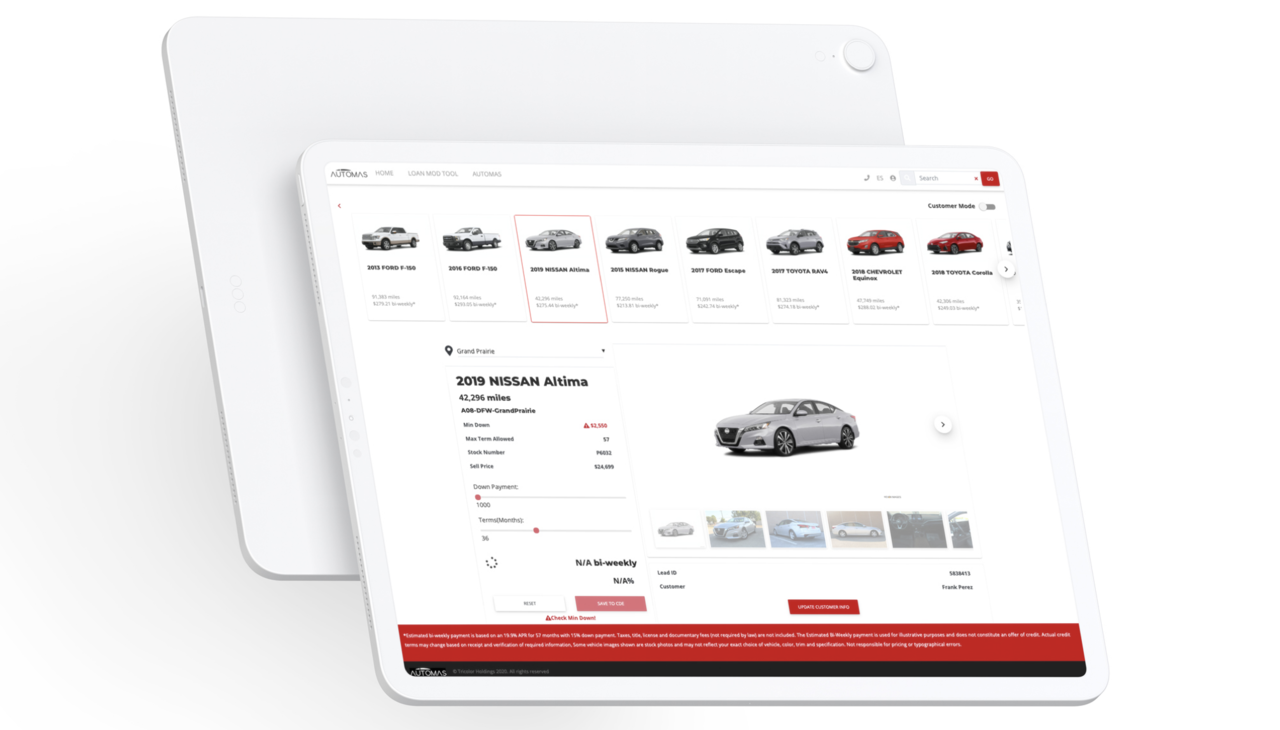

Using robust proprietary data that enables a different value proposition, Tricolor, the nation's largest used vehicle retailer Latinos, recently the successful patent of its interactive artificial intelligence tool called Automás.

The new tool provides data from across Tricolor's integrated platform to offer historically-underserved consumers the power of self-selection when choosing and financing a high-quality, reliable vehicle.

Daniel Chu, Tricolor CEO, said:

From the beginning, we’ve resolved to provide financially underserved customers, a population often subject to extremely limited options and predatory pricing, with an unprecedented premium brand experience that results in both physical and financial mobility.

AI working for Latinos

Emphasizing the transformative results that artificial intelligence offers consumers, Automás provides its customers with the power of self-selection, using machine learning to generate specific offers, both in the vehicle model and the financing conditions.

Although some technology leaders have raised concerns regarding the use of AI, the positive impact of Tricolor's chatbot has enabled financially underserved Hispanic customers with little or no credit histories to have broader options when choosing a car.

“Developed using 16 years of impactful results and more than 25 million non-traditional customer attributes, this breakthrough AI innovation powers an interactive tool that maximizes customer success, expands financial inclusion and sets customers on a path to a better future,” added Chu.

How does it work?

Taking advantage of the information obtained in the application process, Automás offers advice to the consumer to customize their own financing terms, such as the initial payment and the amount of the loan payment within the parameters of the generated system.

RELATED CONTENT

For example, if a customer uses the tool to gradually reduce the interest rate by increasing the down payment, it helps them understand the impact of raising the down payment above the minimum amount to achieve overall savings.

Tricolor noted that unlike conventional vehicle purchases in the United States, which require separate transactions with a vehicle dealer and lender, its integrated model has a unique advantage of ‘end-to-end’ visibility across the entire transaction. It optimizes the process throughout to cater to the buyer's credit.

A U.S. Department of Treasury-certified Community Development Financial Institution (CDFI), Tricolor has disbursed more than $2 billion in affordable auto loans to date as part of its mission to empower underserved Hispanics and provide them with a pathway to a better future.

“We have conviction that the upside of fintech lies in its potential to improve lives. At a time of growing concern about the impact of inflation on consumers’ budgets and rising subprime delinquencies, this is a compelling use of AI for a positive outcome, empowering consumers on a path to more affordable, mainstream credit and a better future,” added Chu.

LEAVE A COMMENT: