Why it is important to budget while determining, and reaching, your financial goals

Preparing a plan based on your current financial situation can go a long way toward achieving your financial goals.

Whether it’s removing ourselves from debt, having a certain amount of money saved up by a particular point in our lives, or reaching financial stability, all of us have our own personal financial goals.

However, long-term and future financial goals can only be achieved if we make smart short-term financial decisions now.

A recent WSFS Bank Money Trends study found that 54% of Greater Philadelphia and Delaware region consumers are concerned about their financial goals, reflecting the increased importance of budgeting during periods of uncertainty.

RELATED CONTENT

With this level of uncertainty, WSFS provides three important tips that can lead to financial stability, and ultimately, success:

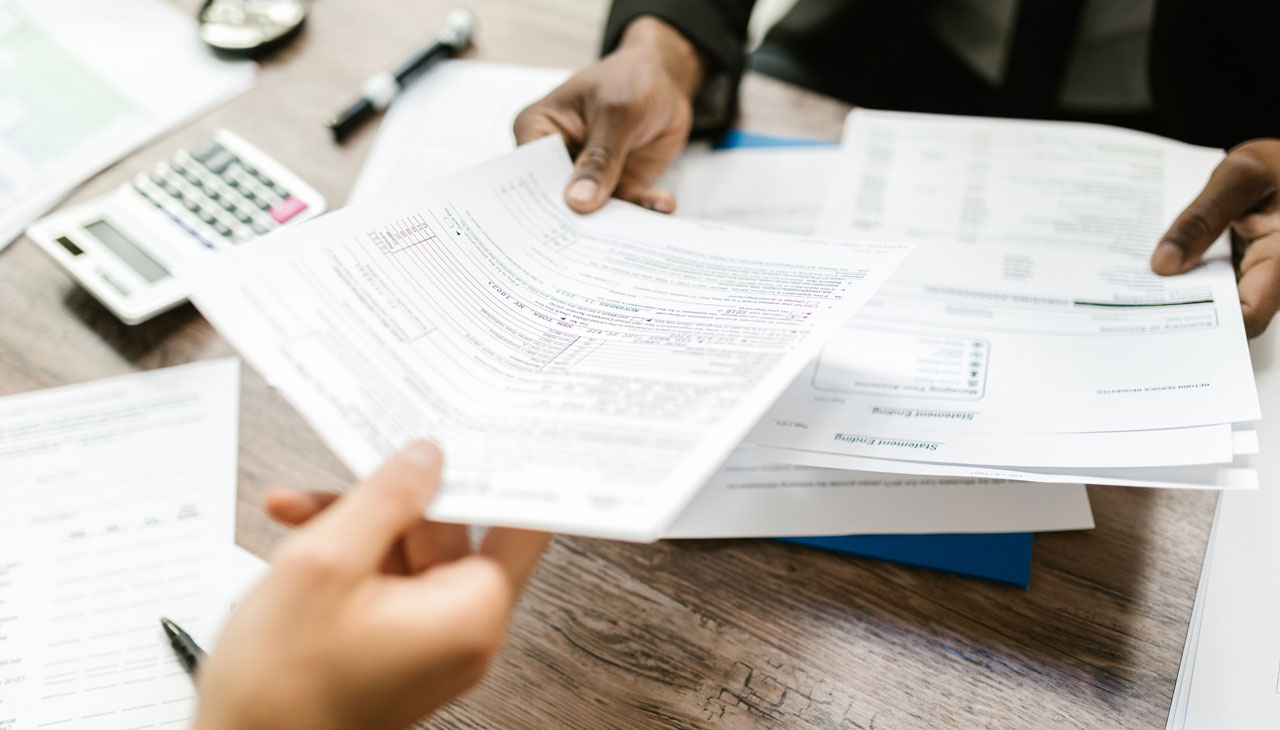

- Evaluate Your Current Finances: When looking ahead financially, it is important to be aware of your present financial situation. Setting up online or mobile banking can be a good way to manage your finances and determine cost savings.

- Account for the Changing Financial Environment: The same WSFS study found that 41% of regional respondents are spending more now than earlier in the pandemic, but rising prices are holding 24% of them back from making large purchases or buying other products they would normally purchase. As inflation has reached a nearly 40-year high, carefully choosing where you do your shopping and hunting for bargains are good options to consider.

- Set Goals and Plan for the Future: Once you are sure of what your current finances are, setting both short-term and long-term goals are paramount. Opening an IRA or money market can be a good investment to maximize your savings and pay contributions.

While these tips can lead to financial stability and success, it’s the short-term goals that can have the bigger impact.

WSFS has also provided three important short-term goals that can pay huge dividends in the long-term:

- Build Your Emergency Fund: Scheduling an automatic contribution to your savings account bi-weekly, or monthly, can create a “cash cushion” within a few months. By doing so, if you are faced with an unexpected emergency, you can avoid taking money out of your retirement savings or taking on a high interest credit card.

- Pay Down Debt: Whether it’s student loans, mortgage or other means, most people have some sort of debt. However, the amount you borrow can differ from the amount you pay, depending on the interest rate. The ideal scenario is to pay off debt at the end of each month, but if you can’t, then focus on the higher interest debt first, then work your way down.

- Save for a Down Payment or Other Large Expense: Buying a house, for example, is one of the largest purchases one will make in their lives. Paying attention to the market can go a long way toward determining how large a down payment you make and how much debt you will be in long-term.

To make the best and smartest decisions on how to manage your finances, it is important to educate yourself on your current personal situation, market trends, how to effectively budget your money, and be able to make both short-term and long-term plans.

LEAVE A COMMENT: