Trump effect? Something is going on with the U.S. economy

An indicator from the Philadelphia Federal Reserve shows that economic activity has been slowing since the beginning of the year. What are the causes?

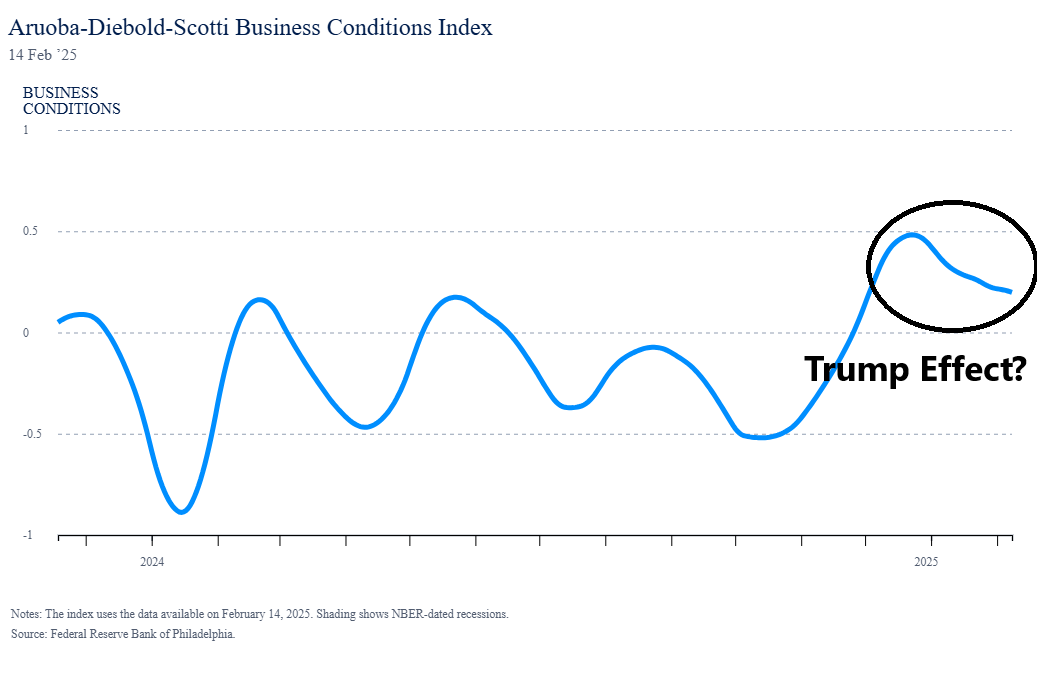

The U.S. economy has entered a period of slowdown in the first months of the year, according to the Philadelphia Federal Reserve's Aruoba-Diebold-Scotti Index of Economic Conditions (ADS). This indicator, which measures economic activity in real time, shows a downward trend since December, reflecting lower dynamism in employment, industrial production and consumption.

Clearly, the government transition has had an impact. After the elections, the indicator touched a high of 0.48 points and in the first week of February it had already fallen to 0.20. Two things may explain this trend. First, unbridled optimism about Donald Trump's resounding victory at the polls and his promises about facilitating private activity and trade. This would explain the boost in the indicator just after the results were known in November. The other aspect was the negative impact on the general business climate and economic activity of his announcements on tariff increases, for example. This would explain the caution among economic agents.

This index combines multiple sources of high-frequency macroeconomic data to reflect the state of the economy more quickly than other traditional indicators. It is updated as new data is released, providing a near real-time view of the business cycle. Among the data used are non-farm payrolls, industrial production, real personal income less transfers to measure consumer purchasing power, manufacturing and trade sales, initial jobless claims and the most recent real GDP data.

As the Philadelphia Fed itself explains, "the average value of the ADS index is zero. Progressively larger positive values indicate progressively better-than-average conditions, while progressively more negative values indicate progressively worse-than-average conditions."

A rarefied outlook

President Trump's various announcements have generated a lot of uncertainty among different economic players. For example, expectations about changes in fiscal, regulatory and trade policies can generate volatility in the markets. This time around, the administration's economic announcements have generated mixed reactions from investors, with concerns about protectionism and fiscal deficit management.

RELATED CONTENT

Trump has reiterated his stance in favor of economic protectionism, including raising tariffs and renegotiating key trade agreements. This has caused uncertainty in the industrial and commercial sector, impacting investment and exports. It also has the collateral effect of increasing prices, which could affect monetary policy. In fact, the FED has already been more cautious with the current rate level and is expected to initiate a new rate hike process at any time this year.

Analyzing the behavior of the ADS Index in the transitions of the last five administrations, we find that the economy usually experiences volatility in these periods.

- Biden (2020-2021): Post-COVID recovery with fiscal stimulus packages.

- Trump (2016-2017): Optimism for tax cuts, but concerns about protectionism.

- Obama (2008-2009): Sharp drop due to global financial crisis.

- Bush (2000-2001): Slowdown after the collapse of the dotcom bubble.

In comparison, the current situation presents similar characteristics to that of Trump in 2017, with uncertainty over trade policies, but without an immediate financial crisis.

This is compounded by structural factors such as inflation, Federal Reserve monetary policy and government borrowing. While employment remains robust, the slowdown in consumption and investment could affect growth in the coming months.

The slowdown in the ADS Index is a warning sign about the near-term state of the economy. However, the ultimate impact will depend on how economic policies evolve in the coming months and how the market reacts to government decisions.

The United States faces a challenging scenario, where private sector confidence and labor market stability will be key to avoid a major recession. The next quarter will be decisive in determining the true direction of the world's largest economy.

LEAVE A COMMENT: