A permanent child tax credit? That’s what could be part of Biden’s next recovery bill

An expansion of the credit was a major inclusion in the $1.9 trillion American Rescue Plan Act.

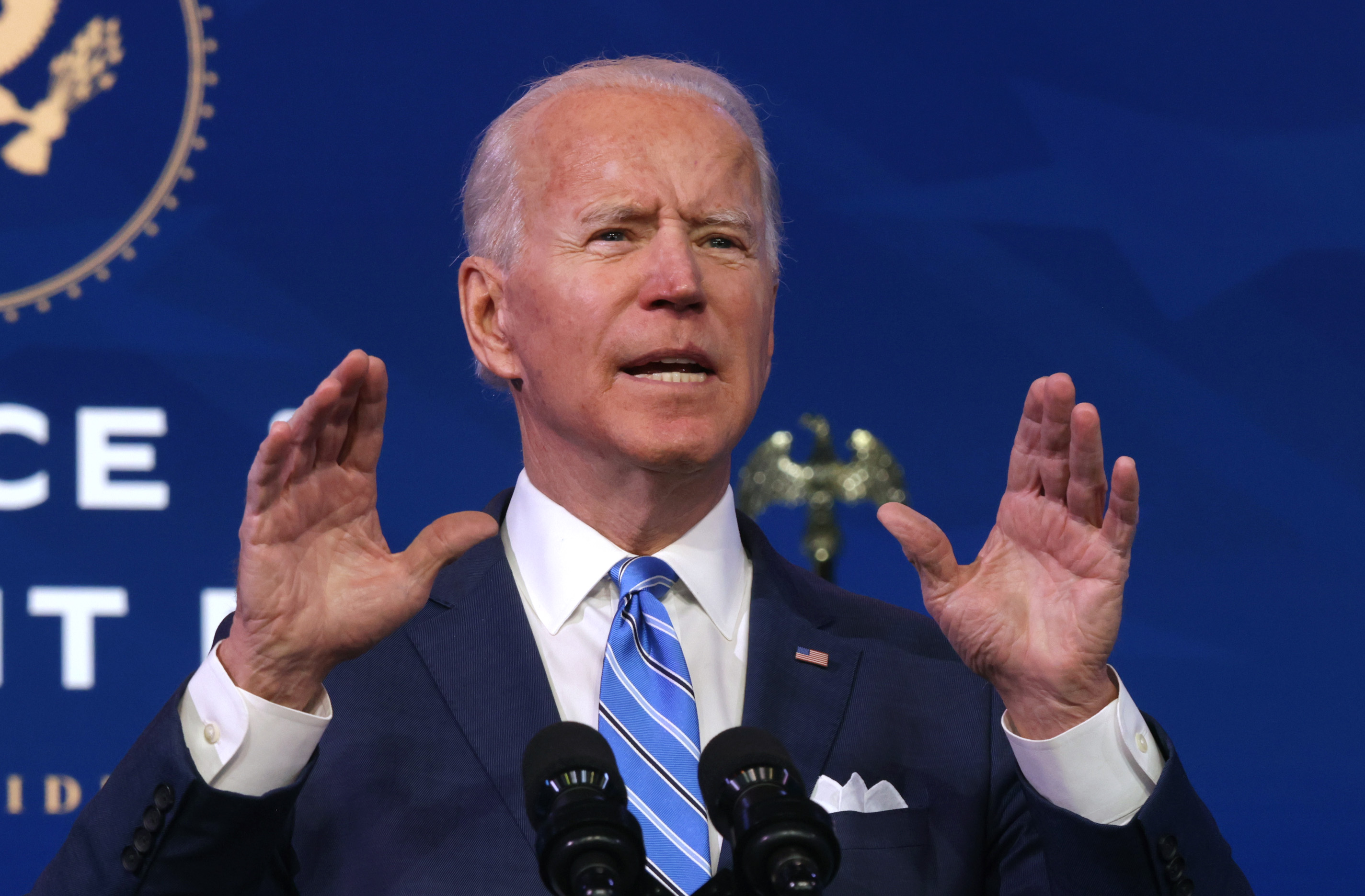

A group of Democrats from both chambers of Congress, including Sens. Sherrod Brown, Cory Booker, and Rep. Ritchie Torres, have joined forces to call on President Joe Biden to permanently expand the child tax credit and implement it into his second recovery plan.

In mid February, Congress unveiled a new and improved child tax credit as part of the president’s $1.9 trillion dollar relief package. The credit, which is based on the taxpayer’s 2020 income, provides $3,000 per child ages six to 17, and $3,600 to children under the age of six.

HAPPENING NOW: I'm joining @SenSherrodBrown, @SenBooker, @rosadelauro, @RepDelBene, and @RepRitchie to call on @POTUS to make the Child Tax Credit expansion permanent.

— Michael Bennet (@SenatorBennet) April 27, 2021

This is the best policy to come out of Washington in generations. We have to make sure it's here to stay.

According to the nonpartisan Center on Budget and Policy Priorities, this updated child tax credit could help to lift nearly 10 million children above the poverty line or at least get them closer to it.

Biden did inform lawmakers with the Congressional Hispanic Caucus in an Oval Office meeting earlier this month that he is interested in an indefinite expansion of the child tax credit, but recognized the challenges the proposal may face when it reaches the Senate.

There are 1,541 babies born into poverty every day in the United States.

— ACLU (@ACLU) April 27, 2021

The Biden administration can address this crisis by making its child tax credit permanent.

We urge it to do so. https://t.co/HT948KOYku

As part of their relief bill in March, Democrats passed a one-year expansion of the child tax credit, which families will begin receiving in July.

Parents can expect to receive half of the credit on a monthly basis between July and December, and the rest will arrive when they file their 2021 tax returns. The credit will also be fully refundable, which gives low-income families a better chance to take advantage of it.

Many Democrats are presenting the argument that this form of necessary financial aid should become permanent. However, Biden’s second recovery proposal, otherwise known as the “American Families Plan,” is set to contain a measure that would only extend the tax credit for four more years.

Appropriations Chairwoman Rosa DeLauro, a Connecticut Democrat who began to push for similar legislation back in 2003, said that she is willing and ready to pursue a permanent solution with the White House.

In an interview with CNN, DeLauro said that for her, this project is the “most transformative economic endeavor that we [House Democrats] could be engaged in.”

No child should grow up in poverty, and that is why my friend @Rosa_DeLauro fought so hard for the child tax credit.

— John Larson (@JohnLarsonCT) April 7, 2021

The American Rescue Plan's child tax credit will cut child poverty in half - we must make it permanent.

The one-year enhancement of the child tax credit is estimated to cost $110 billion, according to the Committee for a Responsible Federal Budget. If it were to become permanent, that cost is predicted to increase significantly towards the realm of $1 trillion over the next 10 years.

In the richest country in the world, we have a moral responsibility to look after our most vulnerable —yet we have one of the highest rates of child poverty in the developed world.We must make the expansion of the Child Tax Credit permanent and end this moral sin.

— Cory Booker (@CoryBooker) April 23, 2021

Democratic Rep. Suzan Delbene of Washington, who serves on the Ways and Means Committee, said that she stressed this particular issue during a meeting at the White House last week with Biden’s Chief of Staff Ron Klain.

RELATED CONTENT

Delbene told CNN that while the expansion in the American Rescue Plan was impactful, children cannot be completely lifted out of poverty in just one year.

“It’s important that we have policy that helps families out for the long run,” she said.

Until now, the credit has only been partially refundable — leaving more than 20 million children without the full credit offered because their families’ incomes are too low.

Lawmakers are also exploring ways to make it easier for parents to use these funds to take care of other expenses throughout the year, leading them to convert half of the monthly credit payments of up to $300, depending on the age of the child.

White House press secretary Jen Psaki said during a press briefing on Friday, April 23, that the administration is currently figuring out how to pay for such a policy.

She lauded the child tax credit, commenting on its value on both reducing poverty levels and helping women successfully return to the workforce.

WATCH: Press Secretary Jen Psaki discusses the inclusion of the child tax credit in Biden’s new bill and asserts “we’ll have to look for what the vehicle is to make it permanent” and that “the President believes it should be part of a permanent package.” pic.twitter.com/eSLt1pYa47

— IT’S TIME FOR JUSTICE (@LiddleSavages) March 12, 2021

"What we're determining is what we can do ... And so, we have to figure out how to pay for it and there's — this is all a part of the discussion,” Psaki explained.

Richard Neal, a Massachusetts Democrat who chairs the Ways and Means Committee, has also been devoting time and energy to this issue, as he relayed to CNN on Friday, claiming that relevant discussions are ongoing within the White House.

"The President took on a bit of a different position. We are trying to figure it out," Neal said. "What that means, I am not quite sure yet. They are open to us finding the revenue. We will have to wait and see."

LEAVE A COMMENT: