[OP-ED]: Trump Tax Plan Builds Wall Around College Education

Far too little attention lands on aspects of the robbery for the rich tax measure that President Trump and his Republican confederates on Capitol Hill are ram…

With Philadelphia holding the embarrassing rank as America’s largest city with the highest rate of poverty and with Puerto Ricans holding the unenviable rank as the most impoverished population segment in the city this Trump/GOP measure that substantially revises the federal tax code is a looming plague.

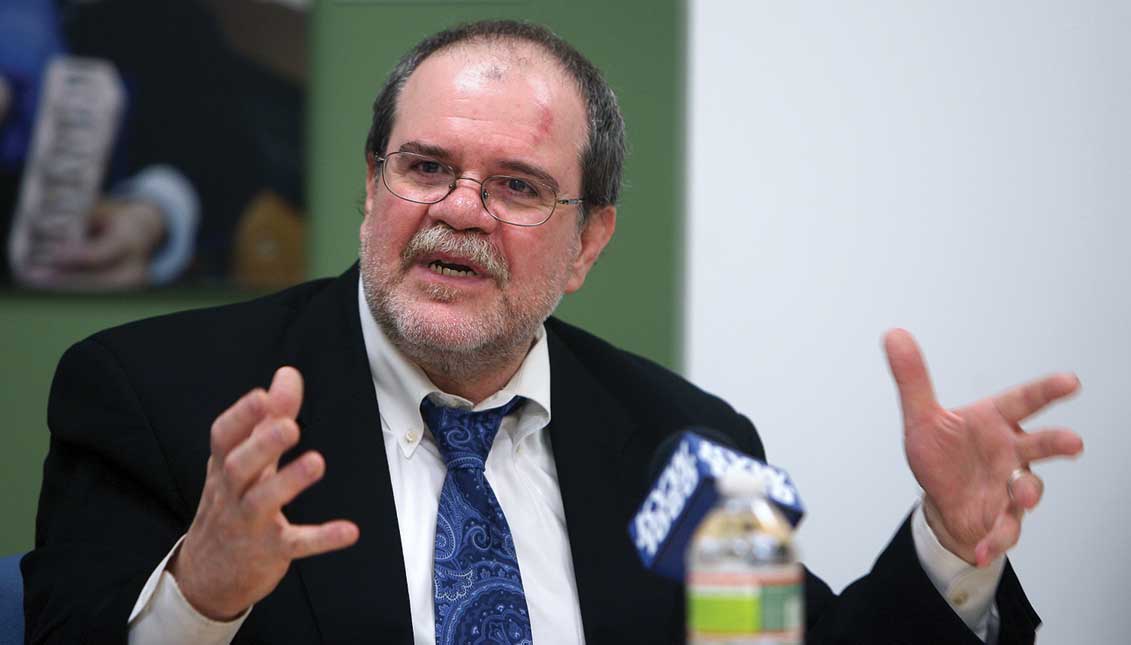

“This is tax reform to the right, not to the left,” the Director of the University of Pennsylvania’s Center for Hispanic Excellence (La Casa Latina), Johnny Irizarry, said.

Provisions embedded deeply in that purposefully mislabeled ‘Tax Reform’ measure drops big bombs on education, that well known escalator out of poverty.

“This is taking money from people with less access to resources to begin with,” Irizarry said during an interview last week.

A huge yet under-examined area within the Trump/GOP tax code changes are its impacts on higher education that threaten to both increase the costs of attending college for students and decrease the financial stability of higher-Ed institutions across America.

Increased costs for college attendance are significant for Philadelphians, particularly those of lower incomes, because Pennsylvania already holds the dubious distinction as a national leader in persons with onerous levels of student loan debt generated from taking the steps touted to improve their lives through attending college.

Average student loan debt for college graduates in Pennsylvania is $34,718 followed closely by the Delaware average of $33,849 and the New Jersey average of $30,104. This tri-state student loan debt burden placed Pennsylvania at #2, Delaware #4 and New Jersey #10 on a list of America’s top 15 states with the highest levels of student loan debt released this past summer.

RELATED CONTENT

Enactment of Trump/GOP tax measures assures explosions in student loan debt levels. Even worse, escalation of college costs closes the door on higher education that opens the pit of poverty wider.

Proposals in the Trump/GOP plan – created by a small conservative cabal that excluded Democrats on Capitol Hill – include eliminating existing tax deductions for interest paid on student loans, taxing fellowships received by grad students, eliminating deductions for charitable deductions to colleges/universities and slapping a new tax on endowments at colleges/universities.

This pick-pocketing of higher education helps pay for tax breaks lavished on wealthy individuals – like UPENN Wharton School grad Trump – and wealthy corporations, many of the same corporations that repugnantly discriminate against non-whites in hiring and promotions.

“Lack of access for quality education” is a key part of the multi-layered, intergenerational matrix of poverty for Puerto Ricans in Philadelphia La Casa Latina Director Irizarry noted.

Issues impacting access to life improving quality education for Philadelphia Puerto Ricans start at an early age compounding as children progress from elementary to high school to college, Irizarry pointed out.

Trump’s tax scam multiplies tax-related misery for all non-wealthy Americans.

LEAVE A COMMENT:

Join the discussion! Leave a comment.