Goldman Sachs “Hunger Bonds” is the fuel that the regime of Nicolás Maduro needed in Venezuela

According to a Wall Street Journal report, the US investment bank, Goldman Sachs, last week made a purchase of bonds issued in 2014 by the Petroleos de…

In front of the critical situation that Venezuela is facing - due in part to the calamitous collapse of its economy and political repression against public displays of discontent - the fact that an investment bank as big as Goldman Sachs has launched an economic lifeline to the government of Nicolás Maduro could be seen as an act of utter ignorance or utter hypocrisy, quoting George Washington University professor Roberto Izurieta.

In a statement issued on Tuesday, Goldman Sachs confirmed the purchase of Venezuelan bonds from PDVSA (Venezuelan state oil company) issued in 2014, which would expire in 2022, for an amount of $ 2.8 billion, of which they only paid 865 million, the equivalent of 31 cents of dollar for each bond, after a "default" discount made by the Venezuelan government.

"We bought these bonds, which were issued in 2014, on the secondary market from a broker and did not interact with the Venezuelan government", Goldman Sachs said in its statement. "We recognize that the situation is complex and evolving and that Venezuela is in crisis. We agree that life there has to get better, and we made the investment in part because we believe it will".

According to El Diario's analysis, this circumstance is not particular, since it is known that the strategy of investing in impoverished and critical countries has been "a big business for investment banking", because the debt of a country like Venezuela "is extremely risky and therefore extremely profitable. "

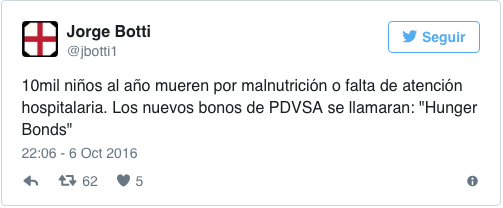

For Venezuelan businessman Jorge Botti, this is "a bond of hunger," publicly denouncing that the government of Nicolás Maduro "prefers to pay international investors to inject money into an economy that has supply problems."

The debt, due in 2022, could generate profitability above 40%, in the event that Venezuela could pay.

Ricardo Hausmann, a former planning minister from Venezuela and a professor of economics at Harvard University, said in an article for Project Syndicate that the returns from Emerging Market Bond Index (EMBI +) from JP Morgan (one of the oldest financial companies that manages private investments) "are deeply influenced by what happens in Venezuela," as the country's index represents about 20% of the return on the profitability of its debt.

Thus, according to Hausmann's analysis, "investing in the EMBI + means that one rejoices when Wall Street analysts inform you that the government is starving its population in order to avoid the restructuring of the bonds that one has".

Due to the fall of Venezuelan imports by 75% between 2012 and 2016 - and by 20% during only the first quarter of 2017 - investors in the

EMBI + would be happy because "it means that more money is left for the payment of interest and capital of their bonds," while Venezuelans are starving and eating from the garbage.

RELATED CONTENT

Therefore, an investment as big as the one made by Goldman Sachs, would be betting on the perpetuation of the Venezuelan economic crisis and the regime of Nicolás Maduro, indirectly supporting the repression and the violation of human rights in the Caribbean country, where inflation is over 400%, there is a total shortage of basic products, food and medicines, which has increased the rate of child death, diseases such as malaria and a widespread health crisis.

If Venezuela's international funding were cut off, Nicolás Maduro’s government would be "strangled" and could accelerate the transition to a democratic government.

National Assembly President and opposition political leader Julio Borges sent a letter to Goldman Sachs CEO Lloyd Blankfein on Monday, warning that any economic commitment adopted by Nicolas Maduro’s government will be invalidated in a "future democratic government".

"Venezuela and its future democratic government will not forget where Goldman Sachs was when he had to decide," reads Borges's letter.

Also, considering the current social crisis in Venezuela, Borges said that the financial bailout granted by Goldman Sachs to Maduro "will serve to strengthen the brutal repression that has been unleashed against the hundreds of thousands of Venezuelans who protest peacefully for a political change in the country".

The nature of this transaction, according to Borges, leaves in clear evidence that "the Maduro regime did not have Venezuela’s best interests in mind ... because the decision to conduct this transaction was made under duress driven by its desperate desire to gain resources needed to secure weapons and other instruments of repression in order to stay in power. "

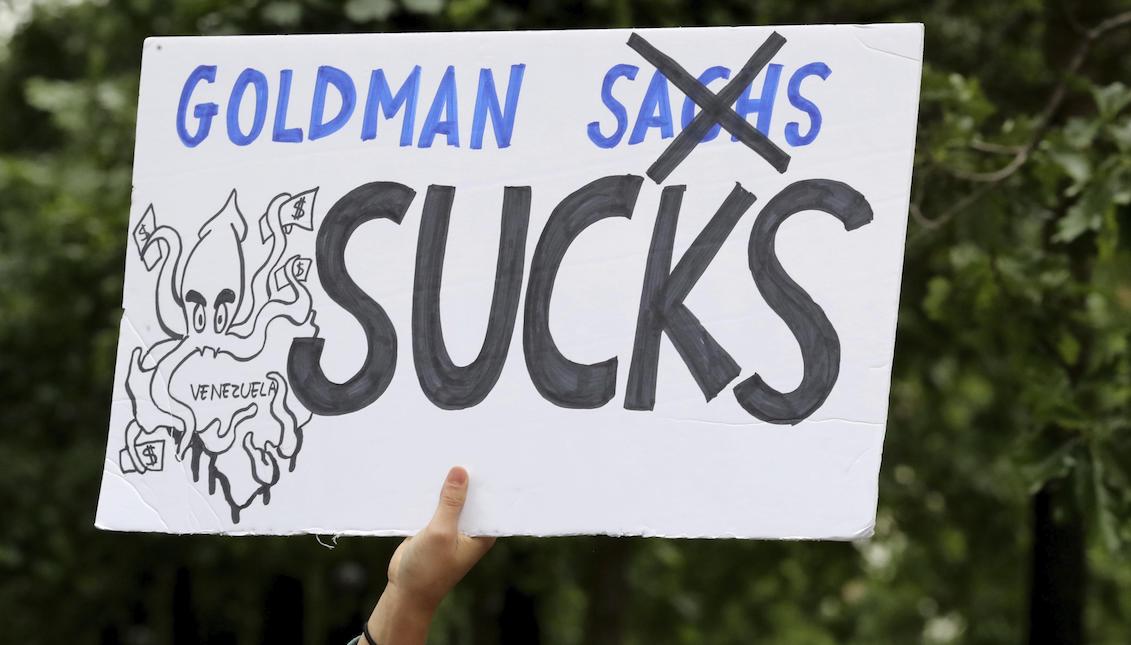

On Tuesday, about 30 demonstrators gathered in front of Goldman Sachs' New York office to show their discontent over the "inhuman" financial measure taken by the bank.

Following the sanctions imposed by the US government on the officials of Maduro's government, Haussman's solution to the current crisis is "to require JP Morgan to immediately exclude Venezuela from emerging market bond indexes, thereby freeing fund managers of the need to compare their results with the hunger bonds."

LEAVE A COMMENT: