The Imminent Risk of Eviction

The Coronavirus crisis has exacerbated the most serious problems in our communities.

For almost four months now, the U.S. has grappled with COVID-19 and come out the loser. After entering the country in late January, the novel coronavirus, as it's also known, spread from West to East gradually at first, then exploded in New York City.

To date, COVID-19 has infected close to one million people in the U.S. and killed more than 50,000. Those numbers put the country top of the world in both infections and deaths attributed to the virus.

The result inside the country is a virtual standstill of daily operations outside of a few states.

Those daily operations include everything outside of grocery stores, newspapers, essential government services, and hospitals.

Everyone else has been confined to their homes for the better part of two months.

For some, their work occupies the time having transitioned along with millions of others to do it remotely. For others, their work couldn't be done from home, and they quickly found themselves having no or precarious incomes.

Many of the latter joined a skyrocketing population in the U.S., it's unemployed.

As of the week of April 20, 22 million Americans have applied for unemployment benefits after being laid off or furloughed from their jobs. That's also likely much higher when considering those that aren't eligible for unemployment benefits, like individuals who work multiple part-time jobs, freelancers, or undocumented immigrants.

The week before, it was 17 million and has rapidly risen ever since the first quarantines were mandated by state governors back at the beginning of March.

With many businesses, especially small ones, relying on their daily or weekly incomes to operate and pay staff, the prolonged shutdown has been a death sentence.

For the formerly employed, the quarantine has curbed costs for transportation and subsequently tanked the price of gas, but there are still payments that need to be made for necessities like food, water, and shelter.

Shelter, in particular, is something that's spawned heated debates across the country.

One of the things becoming increasingly difficult to pay as the quarantine has dragged, especially for those that worked paycheck-to-paycheck, is monthly rent.

We all know what can happen when a tenant can't pay rent.

In many, but not all, states, eviction proceedings have been put on hold in various forms.

In Pennsylvania, its Supreme Court initially put a moratorium on all eviction proceedings until April 3, before extending it to April 30 after Governor Tom Wolf continued the state's shutdown.

On the west coast, California Governor Gavin Newsom signed an executive order allowing local governments to implement their own eviction stoppages. Several, including Los Angeles, San Francisco, San Jose, and San Diego, among other municipalities, have put their own in place.

Elsewhere in the U.S., many cities and counties have also halted evictions in the place of statewide action like in the case of four counties in Florida and Atlanta, Georgia.

However, the moratoriums only represent a delay in the proceedings with courtrooms closed. Those facing eviction before the quarantine will still be evicted when it's lifted, and they could be joined by many others who failed to pay rent for the shutdown's duration.

Some states and municipalities have implemented pauses to filing evictions, and others have banned them if tenants can prove their inability to pay rent is a loss of work caused by COVID-19.

But for the majority of renters around the country, the end of the month still means paying their landlords, quarantine, or not.

In some cases, tenants have faced intimidation from their landlords to move out despite state rulings.

For LizaMarie, who shared her story during the Freedom to Stay town hall in Pennsylvania, her landlord arrived with a truck and team of movers on April 9 to physically evict her for not paying her April rent.

She said she couldn't pay because of the work she lost as a result of the COVID-19 shutdown.

"Now he's harassing me and trying to evict me even though evictions right now are illegal," said LizaMarie.

But not every landlord is threatening their tenants during the pandemic, and many face similar financial troubles.

When a tenant can't pay rent, landlords also likely miss out on mortgage and other utility payments. For those that own a lot of properties, one or two missing payments won't ruin them financially, but also won't stop them from evicting or lobbying against policy changes that offer rent freezes in times of crisis (like these).

The landlords most affected by the COVID-19 shutdown have stories like Maribel's, who also spoke at the Freedom to Stay town hall.

As a landlord of only a few units, she said she'd find it extremely difficult to evict having seen both the financial and psychological toll of COVID-19 on her tenants.

"I know I can't do that," said Maribel.

Despite her understanding, she still acknowledged having mortgages to pay on her properties. For that, Maribel said for any rent cancellation, it needs to be accompanied by the same for mortgages.

"Our lawmakers need to cancel mortgage payments so landlords can cancel rent," she said.

The Freedom to Stay town hall where both Maribel and LizaMarie spoke was organized by nonprofit organizations from across Pennsylvania and featured three lawmakers who proposed a rent and mortgage freeze bill in the state's general assembly.

Very little of the early legislation calls for cancellation of rents or mortgages but does prevent rent hikes in the coming year, such as one urged by New York Mayor Bill de Blasio for the city's regulated apartments.

These rent freezes do not prevent landlords from charging monthly rent but do avoid the annual percent increase in rent for specific apartments.

Similar legislation has passed in San Jose, California, and Washington, D.C.

RELATED CONTENT

However, the public calls on elected officials have asked them to take another step and cancel rents and mortgages for the duration of the coronavirus pandemic.

So far, that's only occurred on an individual basis.

An example is Mario Salerno, a Brooklyn landlord, who owns 18 apartment buildings.

Amid the coronavirus pandemic, Salerno chose not to charge rent to any of his tenants for April.

In a New York Times profile of the gesture, reporter Matthew Haag wrote Salerno "is likely forgoing hundreds of thousands of dollars of income."

His main concern was his tenants' health, as shown by the note he left at each of his complexes announcing the rent cancellation.

"I told them just look out for your neighbor and make sure that everyone has food on their table," Salerno told the Times.

Tenants also said how the gesture had been a significant stress reliever during the panic caused by coronavirus.

But Salerno's kindness is only one in a city with a population of over 8 million, where more than 60% of residents are renters.

Another landlord, Isaac Schwartz, who Newsweek reported, owned around 50 buildings in New York City, has not responded to his tenants' demands of rent cancellation.

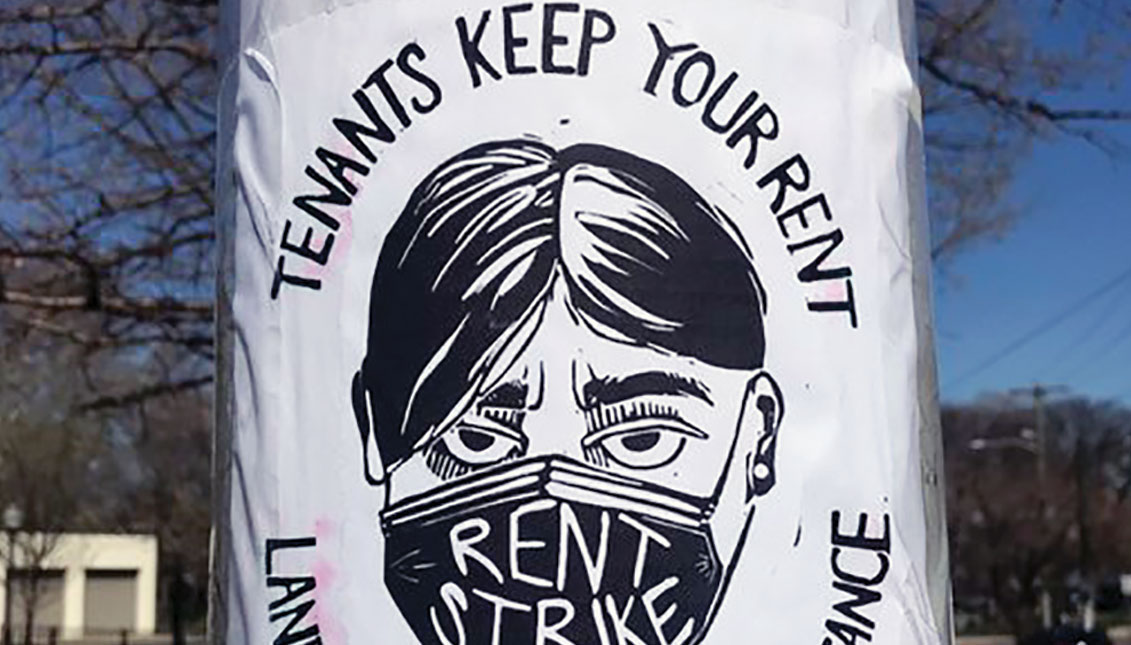

One of them, Maxwell Paparella, said most of the tenants in his Brooklyn apartment complex were striking against paying their rent to Schwartz for April and have urged leaders in the state to institute a rent cancellation for the duration of the COVID-19 shutdown.

"We refuse to go hungry or without medical care to pay rent," he told Newsweek.

New York has been a center for the growing COVID-19 rent strike movement, but similar efforts have been undertaken in California, Florida, Pennsylvania, and Virginia, to name a few.

As of now, leaders have spoken out against rent strikes, and any local legislation to cancel rent has been shot down by lobbying efforts.

But the issue will only gain more steam as the quarantine drags on.

The rumblings seem to have grabbed attention at the federal level. As the first record stimulus bill drains in the face of extending quarantines, more measures have been proposed to aid Americans in dire straits.

Beyond the one-time $1,200 payment as part of the first stimulus bill, another, more robust individual funding bill has been proposed by representatives Ro Khanna and Tim Ryan that would send monthly $2,000 stimulus checks to any American 16 and older.

The other bill is just what tenants and landlords alike have been asking for.

The Rent and Mortgage Cancellation Act, proposed by Rep. Ilhan Omar, would provide full forgiveness on rent and mortgage payments for the duration of the coronavirus pandemic or up to one year.

It would also not allow any debt accumulation for tenants or landlords and set up a relief fund for landlords and mortgage holders to cover losses.

"In 2008, we bailed out Wall Street. This time, it's time to bail out the American people who are suffering," said Omar.

LEAVE A COMMENT: