Three things we learned from Donald Trump's taxes

The New York Times investigation of Donald Trump's tax return between 1985 and 1994 sheds light on the true nature of the man who coined "The Art of The Deal."

If you grew up during the nineties, you might remember the image of Manhattan tycoon Donald Trump, who became famous for his supposed good nose for business, overcoming the risk of falling into bankruptcy more than once.

For the generation of adults at the time, he was a new post-Nixon figure of Rockefeller, and his handling of publicity transformed him into the role model for those who blindly believed in the American Dream.

Fast-forwarding some years, Trump is - surprisingly - the president of the United States, and it takes only a Google search on his name to find out everything that is wrong in that statement.

Since his inauguration, Trump became the second U.S. president to refuse to make his tax returns public, giving investigative journalists a considerable workload, and now forcing Congress to step down to his level in a legal battle for information.

If Donald J. Trump were really a business genius, as he sold in his famous book "The Art of The Deal," closely watching his taxes would be a master class for any real estate entrepreneur.

On the contrary, these documents are now the Department of Commerce's best-kept secret and the headline of a new and extensive report by the New York Times.

Russ Buettner and Susanne Craig obtained the necessary information to recreate Donald Trump's tax returns between 1985 and 1994, reaching conclusions that dismantle the myth of the great tycoon.

The analysis of the figures showed that, by the mid-1980s, and after investing money inherited from his father's real estate business, Trump reported losses of $ 46.1 million in casinos, hotels and commercial premises.

Since then, there was not a year in which he didn't report losses and, according to journalists, "Mr. Trump appears to have lost more money than nearly any other individual American taxpayer."

However, the losses were not accounted for as such.

Although the Times stipulates that Trump's financial losses between 1990 and 1991 "were more than double those of the nearest taxpayers in the I.R.S. information for those years," Trump would have lost enough money to "avoid paying income taxes for eight of the ten years."

The research draws a parallel line between the finances of Donald Trump and his father, Fred C. Trump, who amassed great fortune thanks to his business in construction.

By 2018, now President Trump would have received "at least $ 413 million from his father" who, in comparison, maintained a "stable and profitable empire of rental apartments in Brooklyn and Queens."

RELATED CONTENT

This information is currently being investigated by the Attorney General of New York who has put the magnifying glass on a large part of the projects of the Trump Organization, and whose indications are that "much of the money Mr. Trump had received from his father came from his participation in dubious tax schemes, including instances of outright fraud."

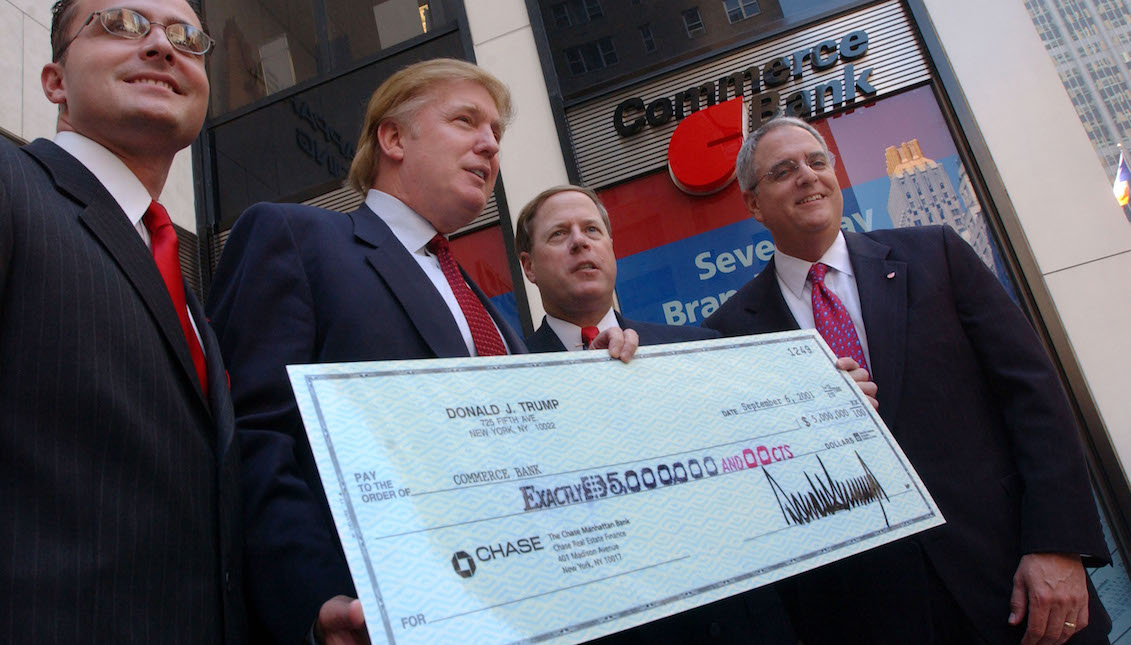

Donald Trump's favorite strategy during his career as a businessman was to use publicity in his favor when it came to shielding his name in financial matters.

A right image was much more potent at that time than your bank records.

In the same way, his campaign was based on the supposed "success" of the businessman when it came to convincing voters that he would be a "master" when taking the reins of the country.

However, the discovery of journalists shows not only that the president seems to be a fiasco in business, but that his real art is to circumvent legal procedures and resort to green paths when fattening his wallet.

What would have allowed Donald Trump to survive economically for so many years was the simple fact of not owning the money he lost. According to the figures of his taxes, the money came from banks and investors and, when that money was over, he could always go back to his father.

Meanwhile, his frequent declaration of economic losses - which totaled up to $ 1.17 billion over ten years - simply allowed him never to pay income taxes.

If there were any doubts about the reason behind his "great tax reform" and his reluctance to make his tax returns public, this report clears them all.

LEAVE A COMMENT:

Join the discussion! Leave a comment.