Lara Rhame speaks on the 2023 U.S. economy

Lara Rhame is an accomplished economist who focuses on macroeconomic financial market analyses to inform and develop long-term views on the economy, investment trends, and issues facing investors.

She was recently invited to speak as the keynote at the 2023 Chamber of Commerce for Greater Philadelphia's Economic Outlook event.

When she discusses the state of the current global economy and outlook for the future, she crystallizes it by answering three questions.

- Are we going to have a recession?

- When will the Fed stop raising rates?

- What will markets do in 2023?

“Let’s face it, 2022 wasn’t necessarily an easy year coming on the heels of a couple of years that have presented really unexpected challenges,” said Rhame.

Two quarters of 2022 saw negative GDP growth, inflation hit a 40-year high, interest rates in financial markets rose tremendously, and the S&P 500 fell by 19%.

These statistics put a particular emphasis on the first question, with the probability of a recession increasing in the past year.

“Given the policy reaction we’ve had to high inflation, if we don’t have a recession — which is not a foregone conclusion — it’s unlikely to be a year of really robust growth,” said Rhame.

What Constitutes Success?

To Rhame, success comes from 90% preparation.

“As we think about our businesses and our communities going forward, going into the coming year with our eyes wide open to some of the cyclical headwinds and macroeconomic challenges is really important,” she said.

When she projects the answers to the aforementioned questions, Rhame believes preparation is the key to producing resilience and finding opportunities when challenges are forthcoming.

A Look at Some Numbers

Growth Domestic Product (GDP) is the broadest measure of output and growth.

In the first two quarters of 2021, the real GDP was between 6-7%, a pace that Rhame describes as a “truly strong, but unsustainable pace of growth.”

By the third quarter, it plummeted to about 3%, before raising back up to about 7%. At the start of 2022, negative growth was shown until the real GDP started creeping back up to the positive side.

Rhame explained, “We’re still experiencing a lot of noise that’s related to the pandemic.”

Inventory swings and international trade are among the things that have been heavily impacted by the pandemic.

CONTENIDO RELACIONADO

According to Rhame, a clearer reflection of domestic demand is the combination of household, business, and government spending, which has remained relatively stagnant — hovering around 2% during the second half of 2021 and into most of 2022.

Economic growth is not just about GDP, however.

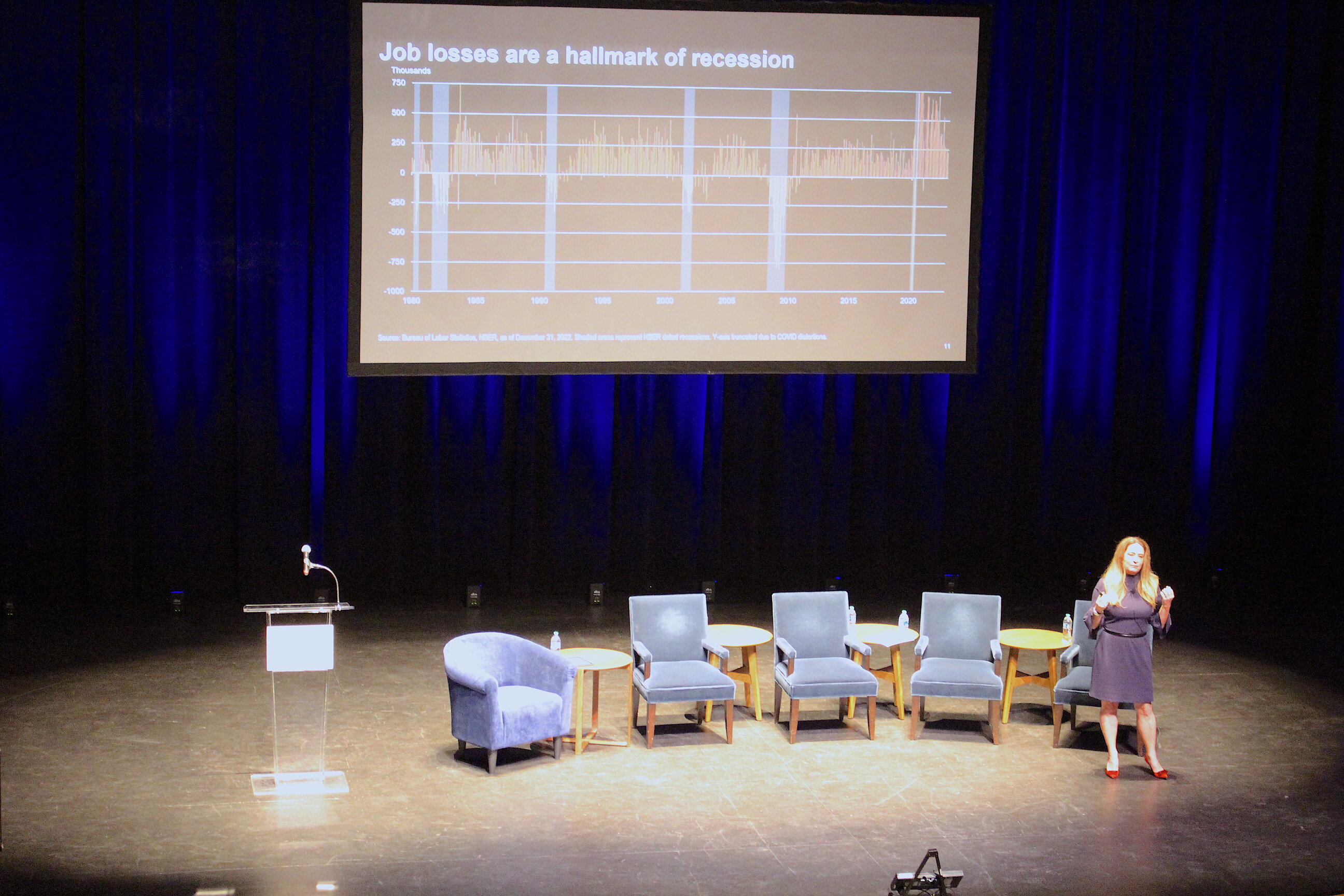

Another important measure to gauge the economy's health is the labor market, as job loss rates are typically the most important indicator of a recession.

“When we look at job growth and monthly job changes, we actually see a really strong view of 2022. In fact, 2022 was a marquee year,” said Rhame.

About 4.5 million jobs were added to the economy last year.

Furthermore, 2022 ended with a 3.5% unemployment rate, matching a 40-year low.

While the job rate has been less of a source of concern, inflation has been among the biggest sources, which peaked at around 9% in the middle of 2022.

“One of the things that we look ahead to is moderating inflation,” said Rhame, highlighting that 2% is the ideal level.

All in all, recessions can range from mild to severe. The United States has experienced both, and has been able to dig its way out every time.

This brings a degree of optimism for the noted economist.

“As we look ahead, there are some macroeconomic challenges, but I see a lot of reasons for positivity and the ability for all of us to navigate them,” said Rhame.

DEJE UN COMENTARIO:

¡Únete a la discusión! Deja un comentario.