GDP Q2 results are in: Is the US heading toward a recession?

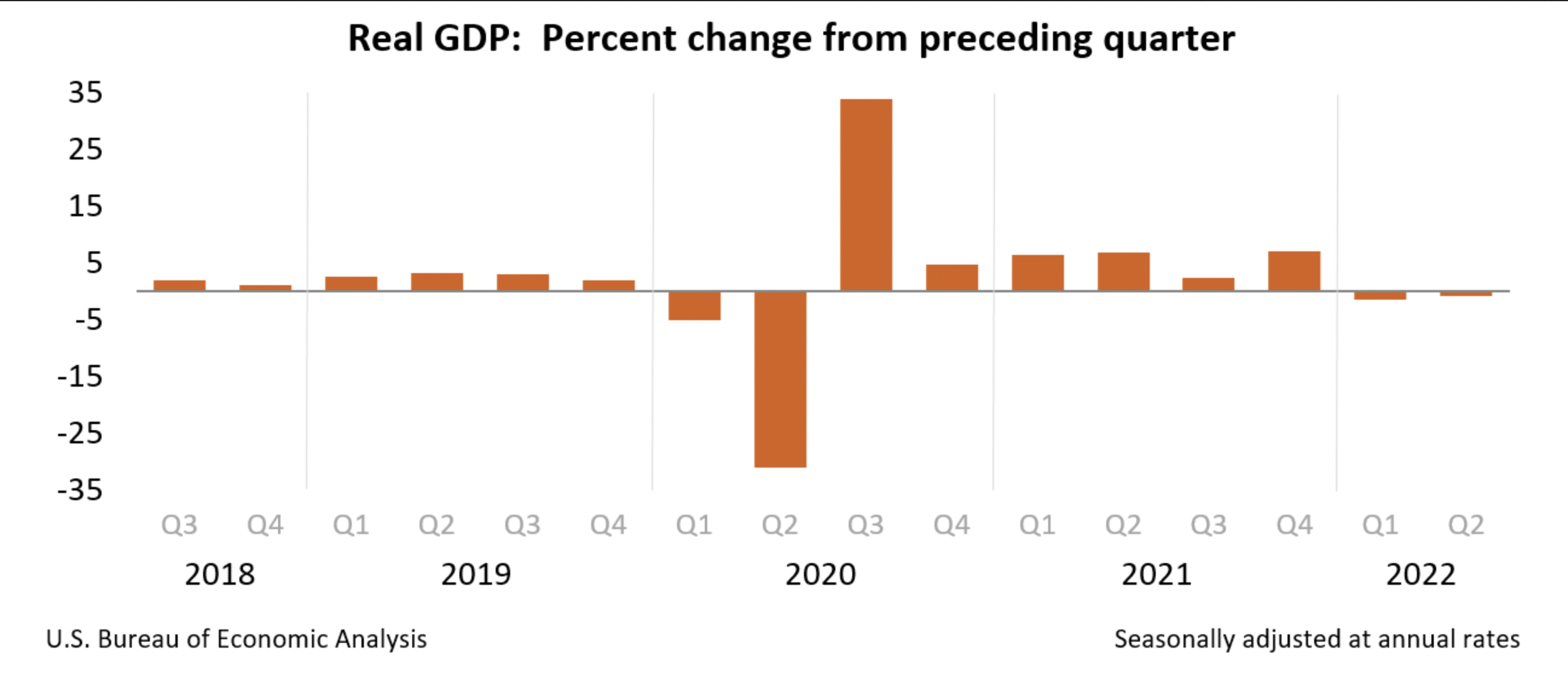

The U.S economy experienced yet another decline as the Bureau of Economic Analysis (BEA) released Gross Domestic Products (GDP) results last Thursday for the second quarter of the year.

According to the advanced estimate, the GDP fell an additional 1.6%, following a previous decline of 0.9% in Q1, fueling concerns of a looming economic downturn.

In a press conference, Chairman of the Federal Reserve Jerome Powell said he did not believe outliers in the U.S. economic activity signaled a recession because several areas in the economy performed strongly.

Powell cited the labor market as one of the key indicators.

“Of course I would point to the labor market (...) if you look at the labor market growth I think payroll jobs averaging $450,000 per month. That’s a remarkably strong level for this state of affairs,” he said.

Powell’s messaging follows the Fed’s decision to raise interest rates by 0.75% for a second time consecutively to mitigate one of the strongest inflationary periods the U.S. has seen in decades.

“You tend to take first GDP reports with a grain of salt,” Powell said. The comments were made a day before the BEA announced the advanced results.

But who decides if we’re in a recession?

Indeed, not the U.S. Federal Reserve. The National Bureau of Economic Research (NBER) is an organization governed by a board of directors comprised of 51 individuals. They are leaders of North American research universities, professional economics organizations, and the business and labor communities.

NBER designates a body of eight individuals who, via a rigorous multi-pronged approach, determine if the outlying factors point to a drastic economic downturn. This group is named the Business Cycle Dating Committee.

Through a select criteria involving depth, diffusion, and duration, the committee determines if the factors under each indicate a recession. It is worth noting that a significant contribution from one aspect can influence the overall conclusions.

While the committee is affiliated with the NBER, a nonprofit organization, they do not publicize meetings or make the public aware in advance of any congregation. According to a report by the Washington Post, the meetings happen sporadically and may have gaps every few years in between.

In their last meeting, the committee declared a recession between April and February, a short stint in U.S. recession-related history.

CONTENIDO RELACIONADO

It must be understood, however, that a steep economic decline is due to a myriad of factors. During the COVID-19 pandemic, the U.S. supply chain observed marked issues affecting inventories across industries.

These issues were exacerbated by Russia’s invasion of Ukraine.

Capitol Hill’s messaging

Amid growing uncertainty surrounding the nation’s economy, the White House attempts to work

through current messaging.

“(...) that is neither the official definition nor the way economists evaluate the state of the business cycle. Instead, both official determinations of recessions and economists’ assessment of economic activity are based on a holistic look at the data,” the White House said in a communication.

It continues to say, “Instead, both official determinations of recessions and economists’ assessment of economic activity are based on a holistic look at the data — including the labor market, consumer and business spending, industrial production, and incomes.”

Capitol Hill echoes Powell's assessment of the current economic activity while also reaffirming that the drop in GDP is not indicative of a recession.

Republicans disagree. The party has shifted its attention to lambasting the administration for “re-defining” what a recession is for damage control. Additionally, polls show that 78% of Republicans believe the country is already in a recession.

The poll also attributes increasing anxiety to right-wing representatives.

Perhaps most interestingly is the theory of a self-fulfilling prophecy, whereas the study argues that perceptions of a recession “may foster the necessary conditions” for a drastic economic downturn.

DEJE UN COMENTARIO:

¡Únete a la discusión! Deja un comentario.