5 things you should know today about the Tax Reform

Today is the most important day in the fight for the Republican Tax Reform, and we want to explain how we’ve gotten here.

After years promulgating the urgency of a tax reform in the United States, members of the Republican Party - with a majority in the Senate, in the House and a president who has monopolized the work of the caucus - have finally come to a more-or-less clear proposal of its Tax Reform, after months of debates and an internal civil war.

This Thursday, the House of Representatives will vote to approve or reject the fiscal proposal, before reconciling it with the proposal of the Senate, and the result could significantly change the economy of the country. That is why we want to explain some key facts:

Last July, GOP members unveiled their budget bill for 2018 before the House of Representatives, setting out their ultimate goal of reforming the US tax system.

After twelve hours of debate, the plan - under the title of Building a Better America - was approved, authorizing then its passage to the Senate to be submitted again to vote.

The project proposes balancing the federal budget by cutting spending and reforming the government, with the promise of "achieving exponential growth in the economy."

As reported by CNN at the time, "the 2018 budget would be a vehicle to change taxes. In the same way that they proposed in their program to repeal Obamacare in the 2017 budget, the leaders of the GOP are using a budget tool called 'reconciliation' to approve the fiscal legislation in the Senate with a simple majority. "

And that was precisely what happened last Thursday, October 19.

As reported by the Washington Post, the Senate approved the Republican budget, allowing the GOP to use a procedural maneuver to pass fiscal legislation through the Senate with 50 or more votes, clearing the need for any type of support from the Democrat senators.

And is that Republicans cannot cut taxes without first achieving the approval of the budget resolution, and that is why all their efforts have focused on getting this to be the first to be approved.

RELATED CONTENT

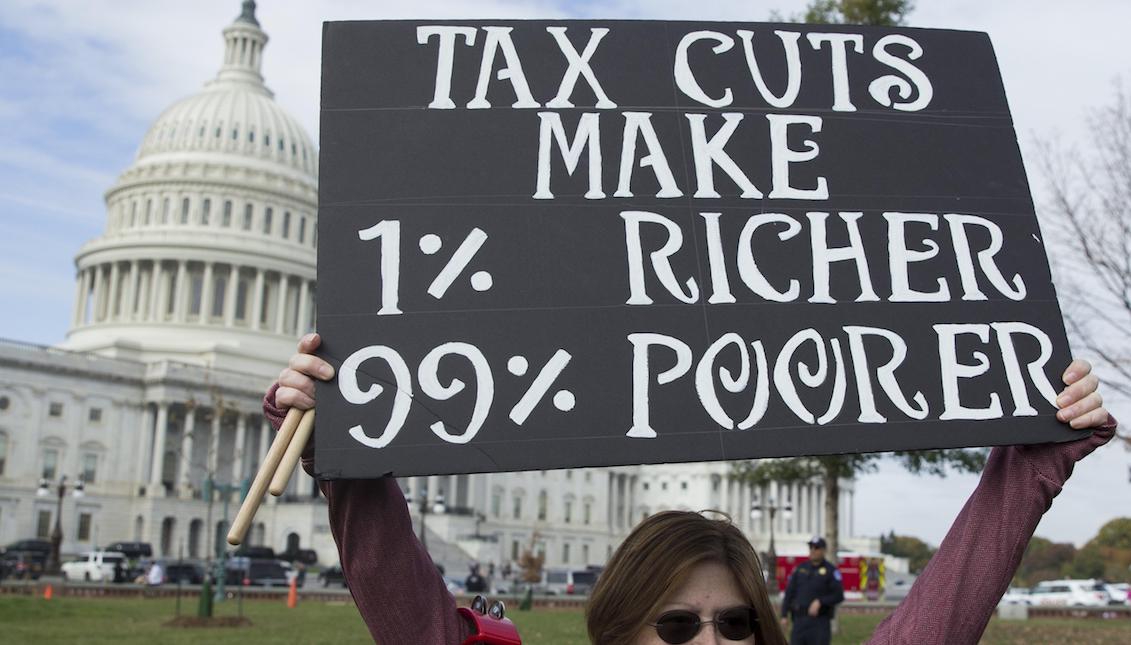

At the same time, and as the Post continues, by agreeing to a "massive fiscal cut," the Senate Republicans have officially displaced the party away from its "promised goal" of ensuring that the "fiscal project would not increase the deficit."

"The White House and the House Republicans had promised that the tax cuts would be compensated with the income from the elimination of certain deductions, but that is no longer the goal of the GOP. On the contrary, they have abandoned the traditional party orthodoxy in the face of deficit reduction and are seeking a political victory after months of frustrations on Capitol Hill."

After months of debates, on November 2, the GOP unveiled its final tax reform project promoting it as "the best solution for the American middle class." The proposal promotes the economic boost through the cuts of corporate rates from 20 to 35%; taxes of only a 10% global minimum in the overseas profits and the elimination of the alternative minimum tax that imposed a higher payment to the families of greater economic income. But not everything that shines is gold: the mortgage deductions will be reduced to $ 500,000 and the property deductions will reach only 10,000, giving a strong blow to the real estate industry. Also, the Republican plan proposes the elimination of deductions in medical expenses; private universities should start paying taxes on investment through a special tax incorporated and pharmacists working in rare diseases research will no longer enjoy the benefits of the tax credit, which will make it very difficult for them to continue their work.

As explained by the Washington Post, the Republican proposal also aims to rescind what is known as "individual mandate", a measure that will take millions of people out of health coverage and "destabilize the Obamacare markets." The measure is essential to recover the money from corporate tax cuts and people with large incomes. According to the Center for Budget and Policy Priorities, this elimination will imply large enrollment declines, increasing the uncertainty and the confusion, and "it will reduce employee enrollment in employer-sponsored coverage and would make it less likely that healthy people sign up for Medicaid before they get sick.” As the Post continues, the individual mandate creates penalties for Americans who don’t have health insurance… “Repealing the mandate would free up more than $300 billion in government funding over the next decade, but it would also eventually lead to 13 million fewer people having death insurance”.

The differences are substantial: the Chamber proposes 4 tax rates, the Senate proposes 7; both tax deductions increase by almost double in each proposal; both approve the disappearance of the Additional Standard Deduction; the Senate maintains the mortgage interest deduction at 1 million but the House reduces it to 500,000; both eliminate state and local income taxes; the House proposes to maintain the tax deduction of properties with a maximum of $ 10,000, but the Senate proposes to eliminate it. Finally, both proposals eliminate the Alternative Minimum Tax (AMT) that prevented the rich from reducing their taxes.

After the Senate approved its proposal, it is the Chamber's turn to approve theirs, in a strategy known as "reconciliation", through which a definitive proposal will be negotiated between both chambers that President Trump will finally sign, if everything continues according to the Republican’s expectations.

LEAVE A COMMENT: