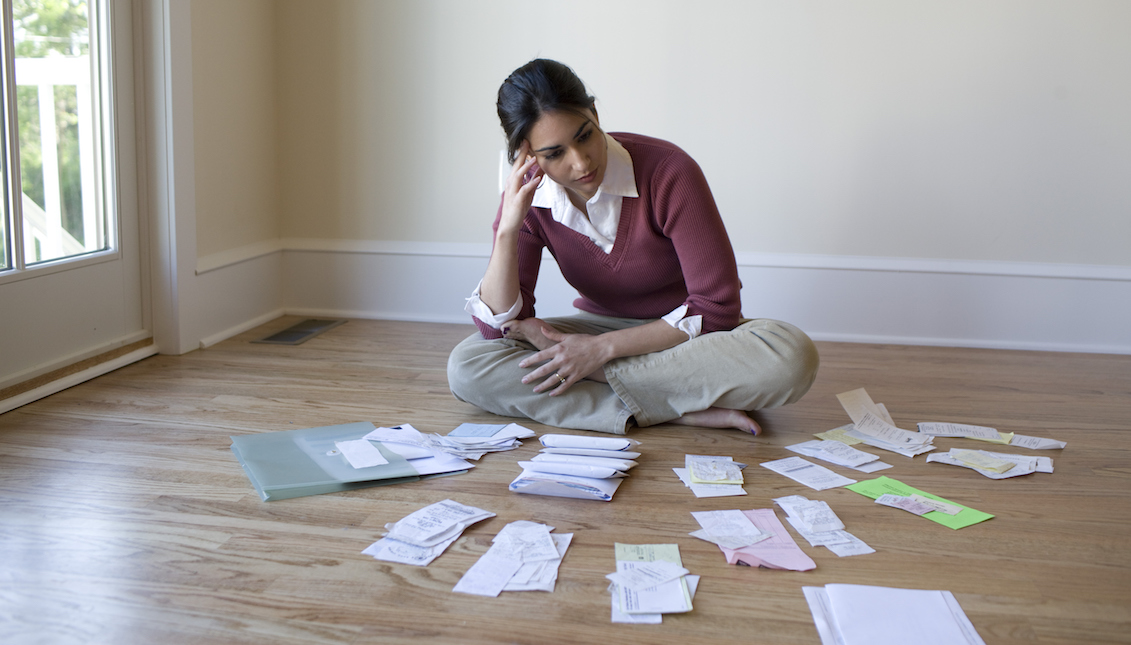

Who should manage my small business finances?

Why finding the right accountant can be the best thing you can do

“I love tax season!” said no one ever.

That’s a meme, by the way, I googled it.

For us small business owners the stress is doubled. I found out early on that managing my business finances was the highest pain point of running my firm.

For starters, I’m not good with numbers; next, I’m highly impatient so reading two-page tiny-font instructions is just not going to happen. Lastly, I’m a worrier. I worry I’ll put the wrong number in those tiny boxes that tell you to add columns C through H and divide it by “huh?”

So from the very beginning, I entrusted my business finances to an accountant.

I was in a hurry, so I went with the first person I spoke with.

This is something I regretted a year later. Despite my inability to run my business finances I’m highly structured and need that from my service providers. I expect them to manage me not the other way around.

This accountant was scarily disorganized. I stayed with her two more years out of not having the time for a proper search.

So this year, I made it a priority to find a new accountant. I wanted to make sure I hired someone who understood both my business and individual financial needs, was highly organized and had a process in place to keep me engaged enough to stay on top of things.

April brought showers and Gladys Ndoumy, MBA, Managing Partner of PBS of Berwyn in Illinois AKA my new accountant into my life. Just in time for Q2 filings! Gladys works with small business owners so I asked her to provide some advice for those who may be early in the process of setting up their business or, like me, looking to make a switch.

My first question is coming straight from where I was five years ago: What are the most significant challenges you see small businesses face when it comes to managing their books?

Many business owners underestimate the learning curve it takes to start and maintain a business. Opening a business is the easy part but maintaining it will be a harder undertaking. If your business doesn’t generate money you will not be able to pay your bills. Start early and create a budget for yourself and the business, set intermediary and long-term achievable goals and work toward them. Eliminate any unnecessary spending to keep the cost down.

What's the best approach a small business can take to keeping their finances organized?

The best advice I give my clients is to maintain a separate bank account dedicated to the business. They should try as much as possible to route all business-related transactions through that bank account. It makes it easier to track revenue and expenses and helps organize and discipline the business owner.

How should expenses be tracked?

RELATED CONTENT

Tracking business expenses has become easier. Besides having all transactions recorded on the bank statement, there is software such as XERO that can link to your banking institution and allow you to download all transactions that appear on the bank statements. The system can identify and categories each transaction automatically.

How do you hire the accountant that is right for you?

I suggest talking to 2 or 3 accountants before making a decision. Look for an accountant that listens, return your phone calls and answers questions directly. Select an accountant that can give you the time you need no matter how small your business is. Firms like Padgett Business Services work with companies with less than 25 employees. Find a firm that has experience in your industry and for your business size. Also, someone that will help you scale and grow.

What are the resources you recommend where small business owners can become better versed on their small biz finances?

Many questions about small biz finance can be answered via a google search but be careful as not all information is correct. The IRS and the Department of Revenue websites are good starting points. In the past few years, those websites have improved tremendously in guiding the small business community. In some cases, they will provide links to other professional organizations.

My reason for hiring Gladys, aside from meeting my requirement for someone well versed in working with small businesses is that she is an entrepreneur herself. This gave me confidence that she understood not only my tax compliance needs but also the emotional component of running a business.

One Last Thing:

In the early stages of my business, I created invoices manually. As volume increased, I needed software to help with this process. Depending on your needs, there is a vast choice of go-to options. I use QuickBooks, but a simple google search will inform you on what’s out there along with user reviews.

The Small Business Administration is a great resource and offers free or low-cost classes that cover the basics of business accounting. I highly recommend taking at least one course to become familiar with the jargon and better understand the accounting process.

I’m back to running my day to day having checked this big to-do off my list finally!

LEAVE A COMMENT: