“You Earned It Philly” campaign urges thousands to take advantage of the federal earned income tax credit

According to statistics collected by the campaign, Philadelphia residents still leave $113 million in Washington D.C.

Despite decreasing its poverty level to its lowest point since 2008, still almost a quarter of Philadelphia residents live below the poverty line.

In response, city leadership has put forth a number of initiatives and ideas to make more dents in the poverty problem. One of them is a doubling down on urging residents to apply for federal earned income tax credit (EITC).

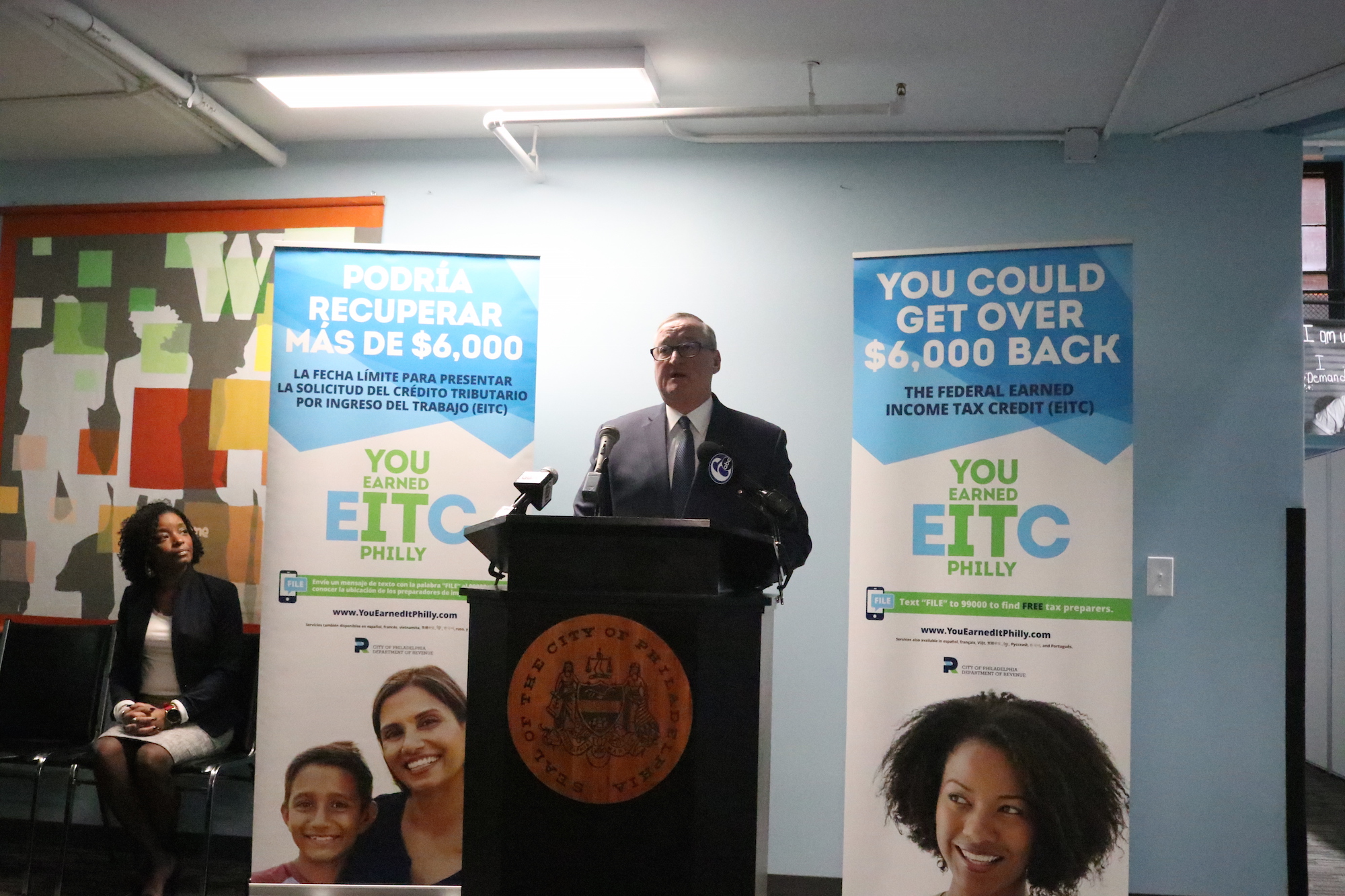

On Jan. 31, officials, including Mayor Jim Kenney and Councilmember Allan Domb, were on hand to announce the city’s annual “You Earned It Philly” campaign.

For this year’s version, Philadelphia has partnered with The Campaign for Working Families, Ceiba and Pathways PA to get the word out about the program.

“All of us have a responsibility for the residents of Philadelphia to do what we can to make sure they receive what potentially could be thousands of extra dollars in tax refunds,” said Mayor Kenney at a press conference in one of the 27 locations residents can receive free tax-prep services (including info about the earned income tax credit).

Federal earned income tax credit isn’t something new. It was first enacted in 1975 under President Gerald Ford, but expanded under President Ronald Reagan in 1986.

At the time, Reagan called it “the best anti-poverty, best pro-family, the best job-creation measure to ever come out of Congress.”

In Philadelphia, 188,000 residents already take advantage of EITC, but the city estimates over 45,000 are still eligible for refunds, which could bring $113 million more to Philly.

The eligible incomes are determined based on the amount of children and dependents, and range between $15,570 for a single head of household with no children to $55,952 for married couples with three or more children.

The maximum refund possible is $6,557.

“Whatever we need to do to get the word out, we need to do,” said Councilmember Allan Domb. “If you don’t qualify, tell five people about it.”

In the past, City Council has passed legislation that also requires businesses employing 20 or more to distribute information about EITC along with tax forms.

Domb is also leading the charge to further support more government refunds by introducing a city wage tax reform bill.

The bill passed council at the end of last year before being pocket vetoed by Mayor Kenney. It was reintroduced at City Council’s first meeting this year.

For Philadelphia’s Latino community, EITC could play a crucial role in elevating thousands from poverty.

At 38%, Latinos have the highest poverty rate of any ethnic group in the city.

In his work at Ceiba, Marcos Lomeli works predominantly with the Latino community to help them access various federal and local aid programs.

RELATED CONTENT

He estimates Ceiba files upwards of 1,300 returns a year, 50% of which qualify for EITC.

“We’re talking about an important asset to the Latino community,” said Lomeli.

Despite the importance, Lomeli’s found that members of the community are often hit-or-miss when asked if they’ve heard of the program.

“Some people have heard it and some people have been claiming it for years, but not everybody,” he said.

Lomeli said progress has been made, but there’s still a lot of work to do for members of the community with limited English.

The “You Earned It” website can currently appear in nine languages, including Spanish.

Another issue potentially facing organizations like Ceiba is a lack of trust for government agencies.

Much like the U.S. Census Bureau’s battle combating misinformation surrounding the upcoming census, the IRS is also often seen as another “big, scary government agency” to avoid giving information to.

“Is my information safe? Is my family going to be safe?” were some of the questions Lomeli cited.

In addition to reassuring that the IRS (like the Census Bureau) will never give out personal information, he said the mindset also reinforces the need for community-based and government organizations to be part getting the word out.

“There is some trust to be built there,” he said.

The last day to file for EITC is April 15, 2020.

LEAVE A COMMENT: