Philadelphia City Council’s Special Committee on Poverty Reduction and Prevention pitches its social safety net to community members

The committee’s first of three subcommittee neighborhood hearings discussed everything from prison reform to potential government assistance programs to combat…

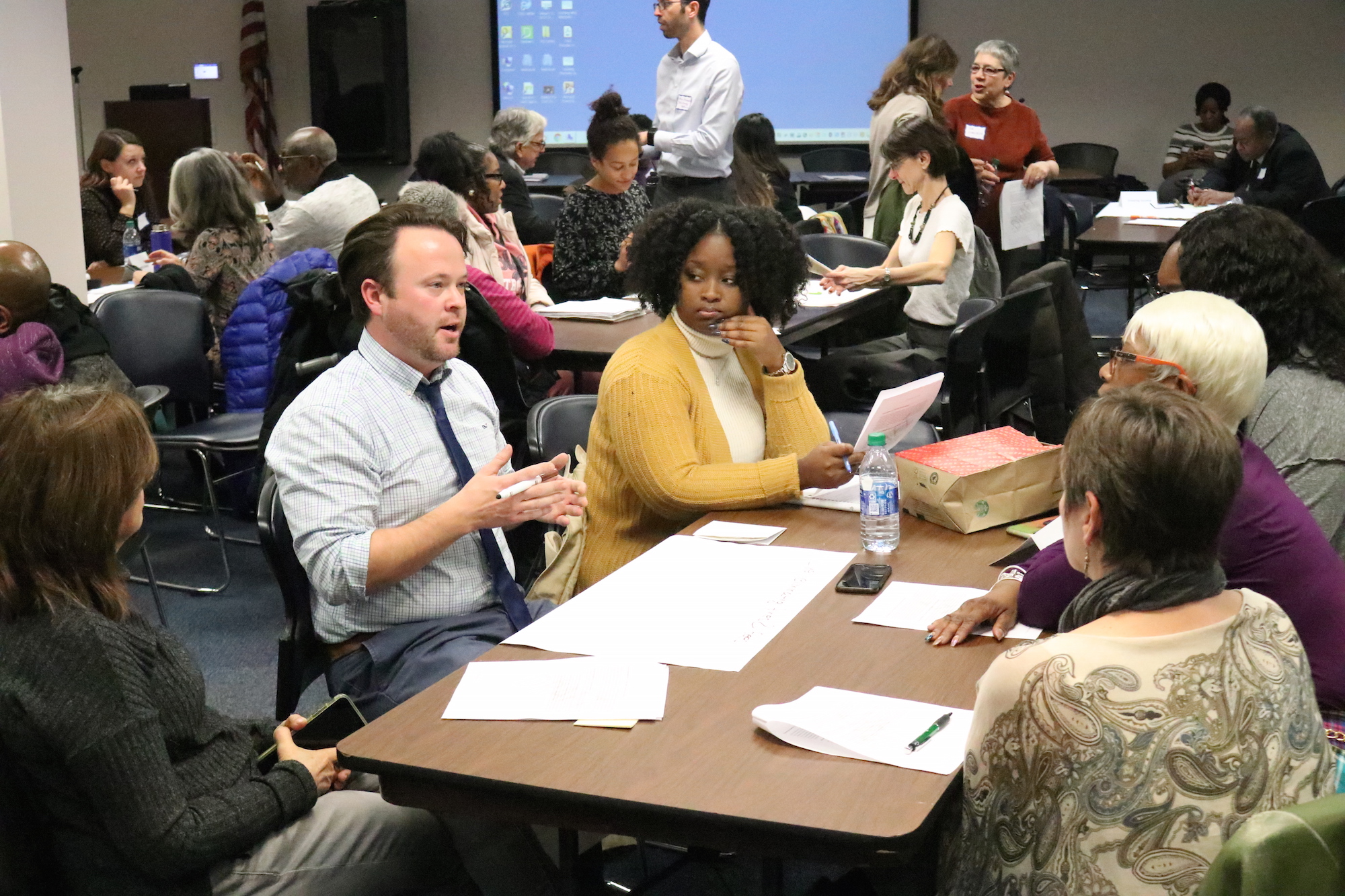

On Nov. 18, some 30 community members from across the city gathered at the Philadelphia Corporation for Aging on Broad Street to collaborate with subcommittee leaders of Philly City Council’s Special Committee on Poverty Reduction and Prevention on providing Philadelphians with a better social safety net.

Committee co-chair Eva Gladstein defined the social safety net as “a collection of services and support to ensure that all Philadelphians are healthy, have the basic building blocks for economic mobility and are well positioned to thrive.”

Gladstein mentioned access to healthcare, nutritious food, housing and basic income support as some of its pillars.

The discussion with community members broke down into three separate categories for improvement: removing barriers, growing income and benefits access.

Solutions under each category were initially brainstormed by smaller groups made up of the 15 subcommittee members and then presented to the attending community members.

Under “Removing Barriers,” the discussion targeted reforms to Pennsylvania’s (and Philadelphia’s) criminal justice system to open more doors for affected Philadelphians.

Since 2015, Philadelphia's criminal justice system has seen improvements like a reduction of the local jail population and closing one of the city’s oldest and largest jails.

But Rachael Eisenberg, Director of Policy and Planning in Philadelphia’s Office of Criminal Justice, told attendees that more could be done.

“Despite the progress that we’ve made, the criminal justice system continues to impact far too many people,” she said.

The main points of improvement presented by Eisenberg and Sharon Dietrich of Community Legal Services revolved around Pennsylvania’s new “Clean Slate” bill.

A year in, the bill will automatically seal over 30 million criminal records.

Dietrich applauded the success of the bill so far, but pinpointed areas where it could improve.

“Our goal at CLS [Community Legal Services] is to make this as broad as it could be,” she said.

For one, many of the older cases are not recorded in the current system by their level, meaning whether something was a felony or misdemeanor isn’t known based on digital data.

The level of a crime determines whether or not it is eligible for sealing under “Clean Slate.” Misdemeanors are, but felonies aren’t.

To solve the problem, the committee recommends that the criminal justice system create a program or initiative to update the older case data in its system.

Another major roadblock still in the way of many Philadelphians having their records sealed is outlying court costs. Right now, records aren’t eligible for sealing if there is still an unpaid fee.

The committee wants to change that by eliminating the court cost as a barrier to automatically having a record sealed.

A final change presented by the committee would also expand the bill to include some non-violent felonies as eligible for sealing.

A majority of the discussion around growing Philadelphians’ incomes pertained to expanding the earned income tax credit (EITC) program beyond the federal level.

The program reduces the amount of taxes low and moderate income individuals and families pay with the potential for a refund.

Will Gonzalez, subcommittee member and Executive Director of CEIBA, says one on the local level in Philadelphia “makes sense.”

“The earned income tax credit, which is a federal program, is one of the most successful anti-poverty programs in the country,” he said.

In addition to one in Philadelphia, Gonzalez also stressed the importance of having one at the state level too, meaning those eligible could potentially receive three separate tax credits depending on the guidelines of each.

At the state level, PA has an EITC for businesses donating to charities and schools, but none for incomes. If enacted, the state would join 29 others with their own versions.

Philadelphia also currently has a wage tax relief bill, introduced by Councilmember Allan Domb that could pass within the next City Council meeting.

Domb’s bill could potentially increase the percentage of wage tax reimbursed to eligible taxpayers to 3.84% by 2024, up from the current 0.5%.

“It’s a start. It’s not a finish...and we can improve on doing more like that,” Domb told attendees.

RELATED CONTENT

According to data gathered by Benefits Data Trust — a partner in the special committee on poverty — Philadelphians leave $450 million worth of federal and state benefits annually.

Mitch Little, of Philadelphia’s Office of Community Empowerment and Opportunity, said this happens often because those eligible don’t know — mostly in the case of non-English speakers and elderly — or because of complex application processes.

Pauline Abernathy of Benefits Data Trust said one way to cut down complexity is to work towards a single application for more than one benefit.

She used the example of the many current benefits available in the city for home repair, and property tax and utility bill relief, etc. which all have different applications.

Not only would an updated process have a single application for all, but also automatically sign up eligible individuals without needing to fill out another form.

Abernathy also stressed the importance of being proactive about advertising the services.

Rather than wait for struggling residents to find them, the city would use the data it has available to target advertising to the eligible residents.

She also mentioned the importance of sending out reminders to residents when the time comes to reapply for the benefits on a yearly basis.

After listening to the three presentations, community members spent almost an hour formulating their own solutions alongside the committee members.

The solutions spanned all three categories.

Under removing barriers, community members supported more employment programs for currently incarcerated individuals before their release and potentially providing the option of community service in place of court fines.

For growing income, a universal basic income was discussed, along with the creation of allotted savings accounts for eligible taxpayers where the tax credits would be stored. Those credits could then be drawn upon for future use after building up over time.

When accessing benefits, community members favored involving more grassroots activists to get the message out for their and providing the information at places where residents congregate such as food banks or transportation hubs.

The attendees also wanted more opportunities to give feedback regarding the overall mission and direction of the Special Committee on Poverty Reduction and Prevention.

It has two more scheduled neighborhood hearings for its other two subcommittees.

The housing subcommittee has a its neighborhood hearing on Monday, Nov. 25 from 4 to 6 pm at Temple University’s Lewis Katz School of Medicine and the jobs and education subcommittee is holding its hearing at Dobbins Technical High School on Dec. 5 from 4 to 6 pm.

LEAVE A COMMENT: