A “paradisiacal” scandal

13.4 million documents have been published by the German newspaper Süddeutsche Zeitung and disseminated through the International Consortium of Investigative…

Islands such as Antigua and Barbuda, Aruba, Bahamas, Barbados, Cayman and Saint Lucia, are not just idyllic destinations to sit by the sea and drink piña coladas. They are also the favorite destination of those who, having mastered unimaginable fortunes, decide not to lose even a penny in taxes.

More than 280 journalists from 67 countries have analyzed 1.4 terabytes of information for more than a year, revealing one of the most important fraud schemes in history.

It is a massive "filtration" of 13.4 million documents from large law firms dedicated to providing offshore services: Appleby, in Bermuda, and Asiaciti Trust, in Singapore.

As explained by the ICIJ portal, the documents (now known as the Paradise Papers) “include nearly 7 million loan agreements, financial statements, emails, trust deeds and other paperwork” from nearly 50 years at Appleby and Asiaciti.

This investigation has revealed "the concealment of heritage and the movement of large amounts of money away from the eyes of the treasury by billionaires and multinationals," according to El Confidencial.

RELATED CONTENT

Companies such as Appleby or Asiaciti are transformed into machines for the creation of fictitious assets, through which large amounts of money are "concealed" or "hidden" to avoid paying the corresponding tax rates. These companies take advantage of the benefits of the so-called Tax Havens (hence the name of the research), to offer their services.

Also called Tax Shelters, tax havens are territories that "apply a tax regime especially favorable to citizens and non-resident companies that domicile for legal purposes in it." Among these advantages, the billionaires or companies manage to get up to the total exemption from the payment of the main taxes and the total secrecy regarding their finances.

These individuals, popularly known as UHNWI (ultra-high-net-worth individual), have fortunes of over 30 million dollars and are the number one customers of companies such as Appleby and Asiaciti.

The 13.4 million documents reveal the way in which multinational companies, millionaires, celebrities and even the Queen of England have hidden assets and moved fortunes "away from tax controls", as the newspaper La Nación explains.

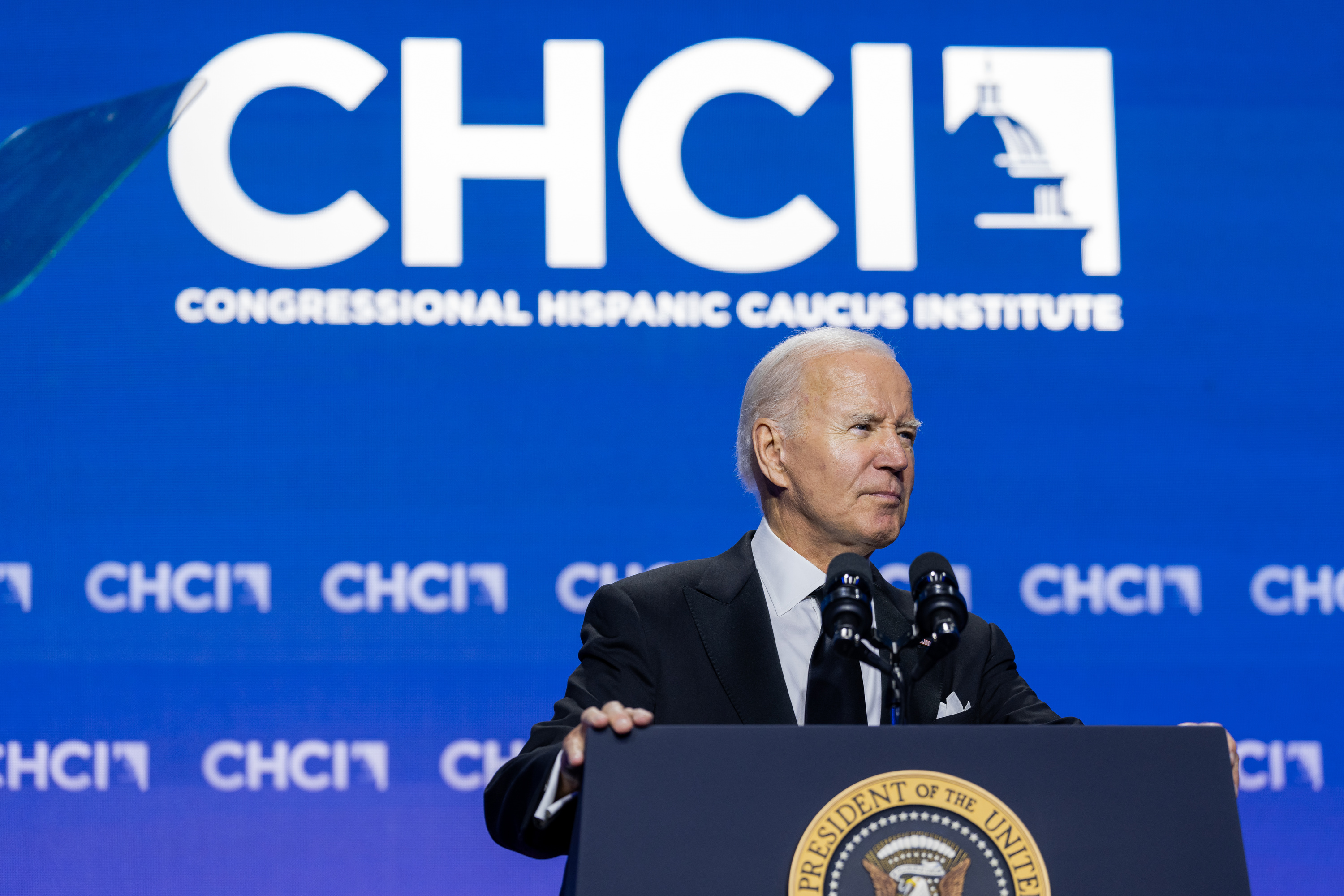

The exposed characters range from individuals in the Trump Administration to Apple, Nike and Facebook.

Also, the documents make public the corporate registers of 19 tax havens, explaining step by step the names of shareholders, administrators and legal representatives of each of the shell companies created in the law firms in order to make "disappear" large sums of money.

While these financial strategies are not entirely illegal - having an account in a tax haven does not have consequences, but not declaring the assets in the tax authorities of the country of origin does - international organizations such as the World Bank have determined that "In the vast majority of cases of corruption, financing of terrorism, money laundering, and fraud, corporate vehicles (such as offshore companies) are used to hide the identity of the people involved in corruption."

That is why the ICIJ and the media have made public the names and figures of the personalities and officials that are inside these documents since, if there is money to hide, it is because their origin is not precisely the most transparent one.

LEAVE A COMMENT:

Join the discussion! Leave a comment.