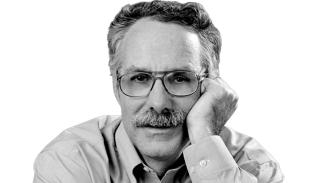

[OP-ED]: Deficits forever?

House Republicans, who are now deliberating the government’s 2018 budget, pledge to eliminate deficits within a decade. Well, good luck with that. It must be…

Anyone who thinks otherwise should consult new figures from the Congressional Budget Office. They show how entrenched deficits have become. The table below, based on the CBO figures, compares three different budget plans for the decade from 2018 to 2027: (1) CBO’s “baseline” budget, a projection of what current policies would produce; (2) the Trump administration’s budget (there’s much overlap with the House budget); and (3) Trump’s budget as modified by the CBO to reflect what it considers more realistic assumptions.

For each budget, the table includes the following: the rise in publicly held federal debt over the 10 years (the debt is the total of annual deficits); the debt in 2027 as a share of our economy (in 2016, debt was 77 percent of gross domestic product); and the deficit in 2027 as a share of GDP.

CBO Baseline Trump Trump/CBO modified

Added Debt $10.1 trillion $3.2 tril. $6.8 tril.

Debt/GDP 2027 91 percent 60 pct. 80 pct.

Deficit/GDP 2027 5.2 percent 0 2.6 pct.

RELATED CONTENT

The table’s clearest message is that even the most optimistic budget -- Trump’s -- involves heavy borrowing over the next decade, roughly $3 trillion on top of the outstanding $14 trillion debt at the end of 2016. Still, on paper, Trump’s plan seems the most appealing. By 2027, it balances the budget, and the debt grows more slowly than the economy (GDP).

There’s the rub. To the CBO -- and many observers -- Trump’s budget is fanciful. A big difference involves economic assumptions. The White House expects GDP to grow about 3 percent annually over the decade, much higher than the 1.9 percent that CBO and many private economists expect. The difference over a decade is worth about $3 trillion, mostly tax revenues. Faster economic growth generates higher revenues, because the tax base -- wages, salaries, profits -- is larger.

Any viable budget plan faces a harder problem. As baby boomers retire, Social Security and Medicare spending increases, intensifying pressures to raise the deficit, cut other spending or increase taxes. Especially vulnerable are so-called “discretionary” programs -- military spending and domestic activities such as the FBI, the EPA and Centers for Disease Control. In the last 50 years, these discretionary programs have averaged 8.6 percent of GDP. They’re already down to 6.3 percent of GDP, and the White House expects them to drop to 4.1 percent of GDP.

The administration counts this decline as a spending reduction, but the level is so low that future Congresses, regardless of party, may balk at enacting such deep cuts. Already, there’s resistance to some of the cuts proposed by the administration for its 2018 budget, including a 32 percent decline in spending for international relations and a 37 percent drop in community and regional economic development.

The bottom line: The federal budget remains badly out of whack, even though we are near or at “full employment” (June unemployment rate: 4.4 percent). We cannot afford tax cuts; we need tax increases. Nor can we afford to exempt Social Security -- nearly a quarter of all federal spending -- from any cuts.

In an era of an aging population and slower economic growth, there is no consensus on how big the government should become or how its spending should be financed. The continuing large deficits are not a policy so much as evidence of drift and indecision. They are likely to persist until some sort of debt crisis -- by no means inevitable -- forces action or America’s political leaders decide to engage the unpopular question of paying for popular government.

LEAVE A COMMENT:

Join the discussion! Leave a comment.